Get Assessment Review Board

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Assessment Review Board online

This guide provides comprehensive step-by-step instructions for users who need assistance in completing the Assessment Review Board online form. Whether you are new to the process or need a refresher, this guide aims to support you through every section of the form effectively.

Follow the steps to successfully complete your online form.

- Press the 'Get Form' button to access the Assessment Review Board form and have it displayed in your editing tool.

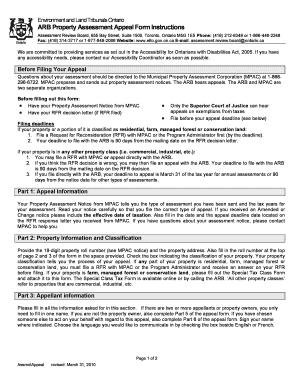

- Begin with Part 1: Appeal Information. Here, indicate the type of Property Assessment Notice you received from the Municipal Property Assessment Corporation (MPAC) and verify the necessary details like the tax year and assessment notice mailing date.

- Proceed to Part 2: Property Information and Classification. Enter the 19-digit property roll number and your property address. Ensure to check the classification box that reflects your property type.

- In Part 3: Appellant Information, fill in all requested details about yourself. This includes your name, contact information, and whether you are the property owner. If you are not the owner, complete Part 5.

- For Part 4: Reason(s) for Appeal, select from the provided options that apply to your case. If your reason is not specified, write it briefly under 'other'.

- If you are not the property owner, complete Part 5: Third Party Appeal Information. Provide the property owner's details and confirm that you sent them a copy of this appeal.

- Next, in Part 6: Representative Authorization, if applicable, provide details about your representative and confirm that you have written authorization for them to act on your behalf.

- In Part 7: How to File an Appeal, select your method of submission, which can be online, by fax, or by mail. Follow the instructions for the method chosen.

- Finally, in Part 8: Required Filing Fee, indicate the amount of the filing fee based on your property class, and provide the payment information as required.

- Once completed, save your changes, then download, print, or share the form as needed.

Complete your Assessment Review Board documents online to ensure a smooth filing process.

The best evidence for a property tax protest typically includes recent sales of comparable properties in your area, detailed photographs highlighting any deficiencies, and any discrepancies in your property’s description. This solid evidence should be compiled and presented clearly to the Assessment Review Board, as it strengthens your case and increases your chance of a favorable outcome.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.