Loading

Get Rc96

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rc96 online

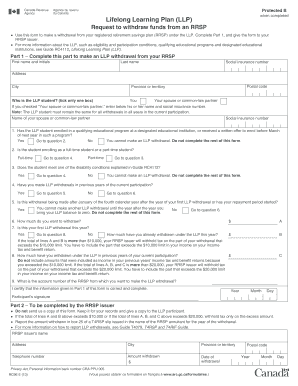

The Rc96 form is essential for individuals looking to withdraw funds from their registered retirement savings plan (RRSP) under the Lifelong Learning Plan (LLP). This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the Rc96 online successfully.

- Press the ‘Get Form’ button to access the Rc96 form and open it in your chosen editor.

- In Part 1, provide your first name and initials, last name, social insurance number, address, city, postal code, and province or territory.

- Indicate who the LLP student is by ticking the appropriate box: 'You' or 'Your spouse or common-law partner'. If you choose your spouse or common-law partner, enter their name and social insurance number.

- Answer the first eligibility question: Has the LLP student enrolled in a qualifying educational program or received a written enrollment offer? If 'No', you cannot continue.

- Specify whether the LLP student will be a full-time or part-time student.

- If the student is part-time, verify if they meet the disability conditions as detailed in Guide RC4112. If 'No', you cannot continue.

- If you have made LLP withdrawals previously, indicate this. If 'Yes', proceed to the next question.

- Determine if this withdrawal is after January of the fourth calendar year from your first LLP withdrawal. If 'Yes', note that you cannot make another withdrawal until the following year.

- Specify the amount you wish to withdraw from your RRSP.

- Indicate how much you have withdrawn under the LLP in previous years of the current participation.

- If this is your first LLP withdrawal this year, note it. If 'No', report how much you have already withdrawn this year.

- Provide the account number of the RRSP account from which the withdrawal will be made.

- Lastly, certify that the information entered in Part 1 is correct and complete by signing and dating the form.

Begin your online application process by filling out the Rc96 form today.

Filing computation typically requires detailing your income, deductions, and relevant tax information. Use your TDS utility to input this data directly, following its prompts for calculation and submission. This efficiency can lead to smoother Rc96 processing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.