Loading

Get Form 920

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 920 online

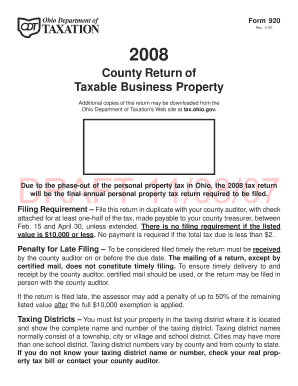

Filling out the Form 920 online is a straightforward process that allows users to report their taxable business property in Ohio. This guide provides clear instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out Form 920 online.

- Press the ‘Get Form’ button to obtain the form and open it in your browser.

- Enter your taxpayer identification information in the designated fields. Make sure to indicate the name as registered with the Ohio Secretary of State or with the local county auditor.

- Fill in the taxing district number and name based on the location of your property. You can verify this information through your real estate tax bill or by contacting your county auditor.

- Complete Schedule 2 by entering the listed values for manufacturing machinery and equipment, ensuring to round to the nearest $10.

- Continue by filling out Schedule 3 and Schedule 3A for manufacturing inventories and merchandising inventories, respectively. Again, round values to the nearest $10.

- Provide the total listed value in the designated section and calculate the $10,000 exemption, subtracting this from your total to find the taxable value.

- Determine the tax rate for your taxing district and calculate the tax due. Enter the amount paid with the return, which should be at least half of the total tax.

- Review all entries for accuracy. Make necessary adjustments to align with the provided guidelines.

- Once completed, save your changes. You may choose to download, print, or share the form as needed.

Complete your Form 920 online today for accurate and timely submission.

Generally, any person or business that pays wages to an employee must file a Form 941 each quarter, and must continue to do so even if there are no employees during some of the quarters.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.