Loading

Get What Does Form 668d Look Lik

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Does Form 668-D Look Lik online

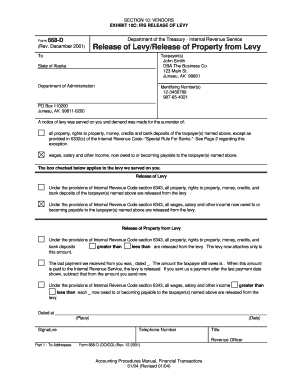

Form 668-D is essential for the release of levy actions by the Internal Revenue Service. This guide will walk you through filling out this form online, ensuring that you understand each component thoroughly.

Follow the steps to successfully complete Form 668-D online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Identify the taxpayer information section. Enter the legal name of the taxpayer and the DBA (doing business as) name if applicable. Include the complete address for accurate processing.

- In the Identifying Number(s) field, input the taxpayer's Social Security Number or Employer Identification Number as specified.

- Review the notice of levy section, ensuring you provide the information corresponding to the property, rights, or income that is under levy.

- Select the appropriate checkbox for either the release of levy or release of property, depending on the situation that applies.

- If applicable, fill in the relevant amounts regarding the last payment received and the outstanding amount owed to the IRS.

- Complete the signature section including the name of the Revenue Officer, date, and contact telephone number.

- After filling out all sections, ensure all information is accurate, then save changes, download, print, or share the completed form.

Complete your documents online with confidence and ease.

Related links form

Form 668 A is a Notice of Federal Tax Lien while Form 668 W is a Notice of Levy on Wages or Salary. The former indicates the IRS's claim against your property, while the latter allows them to seize your wages. Knowing these differences is key to understanding the IRS's actions. For assistance in handling these forms, U.S. Legal Forms can provide clarity and support.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.