Loading

Get Declaration Under Section 197a1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Declaration Under Section 197A(1) online

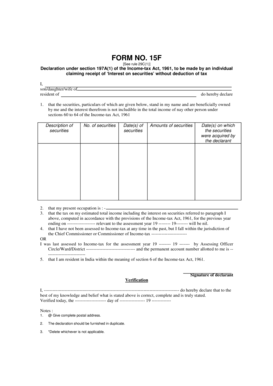

Filling out the Declaration Under Section 197A(1) can be a straightforward process if you follow the correct steps. This guide aims to assist you in completing the form accurately to claim receipt of interest on securities without tax deduction.

Follow the steps to fill out the Declaration Under Section 197A(1) online.

- Click ‘Get Form’ button to obtain the form and open it in the editor. This will allow you to access the Declaration Under Section 197A(1) electronically.

- Begin by providing your full name in the space provided, indicating whether you are a son, daughter, or partner of someone, followed by your residential status. This information establishes your identity and confirms your eligibility.

- Next, list the details of the securities that you own. Include the description, number, and the relevant dates associated with each security, ensuring accurate information is provided as it is essential for your declaration.

- State your current occupation clearly. It is necessary for tax assessment purposes and establishes your financial background.

- Indicate your estimated total income, including the interest from the securities listed previously. You must affirm that this total income, computed according to the Income-tax Act, will be nil for the relevant assessment year.

- Provide information regarding your previous income tax assessments. You may either confirm that you have not been assessed in the past or specify the details of your last assessment, including the assigned Assessing Officer's Circle or Ward.

- Acknowledge that you are a resident of India as defined under section 6 of the Income-tax Act by adding your signature at the designated space.

- In the verification section, reaffirm that the information provided is correct and complete to the best of your knowledge. Insert the verification date and sign accordingly.

- Review the form to ensure all fields are completed accurately. Once satisfied, you can save the changes, download, print, or share your completed Declaration Under Section 197A(1) as required.

Start completing your Declaration Under Section 197A(1) online today to ensure your interests are protected.

Filling out a customs declaration involves listing the items you are bringing into the country, along with their values. Be honest and accurate about the contents of your luggage or shipment to avoid complications. Additionally, you might need to specify how long you plan to stay and your travel itinerary. Utilizing USLegalForms can simplify the process with easy-to-follow templates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.