Loading

Get Form 668 A Ics

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 668 A Ics online

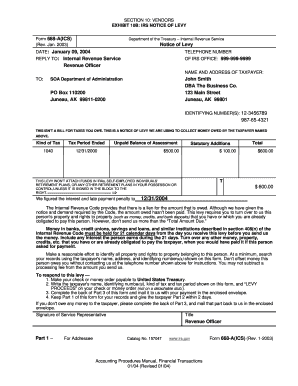

Filling out the Form 668 A Ics online can be a straightforward process if you follow the right steps. This guide is designed to help you understand the components of the form and provide clear instructions for completing it efficiently.

Follow the steps to complete the Form 668 A Ics online

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the taxpayer’s name in the designated field. Make sure to provide the exact name as it appears on official documents.

- Fill in the name and address of the taxpayer's business if applicable. Use the 'DBA' field if the taxpayer operates under a business name.

- Input the identifying number(s) for the taxpayer. This may include Social Security numbers or EINs.

- Specify the kind of tax owed in the designated section, indicating the tax type associated with the levy.

- List the tax period ended for which the levy is being issued. Ensure this date is accurate.

- Complete the unpaid balance section by entering the amount owed. Include any statutory additions if applicable.

- Review the section regarding retirement plans, ensuring the necessary box is checked if applicable.

- Fill out the details for payment processing, including how to make the payment and what information to include on the payment.

- After completing the form, save your changes. You may choose to download, print, or share the form as needed.

Start completing your form online today to ensure a smooth process.

A demand for payment of levy is a formal request made by a tax authority, informing you of the amount due and the consequences of non-payment. This document serves to notify the taxpayer of the impending action if the debt remains unpaid. Using Form 668 A Ics can assist you in addressing such demands efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.