Get Sba 3508 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 3508 online

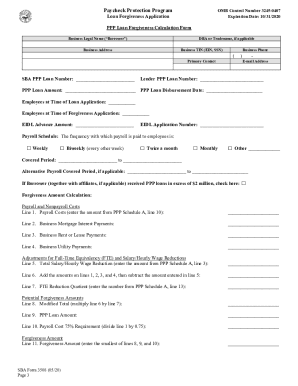

This guide provides a comprehensive overview for users looking to fill out the SBA 3508 Loan Forgiveness Application online. Our aim is to equip you with clear and detailed instructions for each section of the form, ensuring a smooth and efficient application process.

Follow the steps to accurately complete the SBA 3508 form.

- Click ‘Get Form’ button to access the SBA 3508 form and open it in the editor.

- Enter the Business Legal Name, DBA or Tradename (if applicable), and Business TIN (EIN or SSN) as found on your Borrower Application Form.

- Provide the Business Address, Business Phone, Primary Contact, and E-mail Address, ensuring the information matches your Borrower Application Form unless there are updates.

- Input the SBA PPP Loan Number provided by your Lender at the loan approval stage or request it if it is not readily available.

- Fill in the Lender PPP Loan Number assigned to your loan by your Lender.

- Enter the PPP Loan Amount which corresponds to the total principal amount disbursed to you.

- Document the number of Employees at the Time of Loan Application and at the Time of Forgiveness Application.

- Include the PPP Loan Disbursement Date, recorded as the date when you received the loan proceeds.

- If applicable, enter the EIDL Advance Amount received and the EIDL Application Number.

- Select your Payroll Schedule from the available options to indicate how frequently payroll is disbursed.

- Specify the Covered Period, indicating the first and last days of the 56-day period starting from your PPP Loan Disbursement Date.

- If you choose to use an Alternative Payroll Covered Period, indicate these dates accordingly.

- Check the box if you received PPP loans in excess of $2 million along with your affiliates.

- Complete the Forgiveness Amount Calculation by entering appropriate figures for payroll and nonpayroll costs in lines 1 through 11. Refer to the PPP Schedule A for specific details related to these calculations.

- Review your entries for accuracy and completeness before saving or submitting the form.

- Finalize the application by saving changes, and download, print, or share the form as needed.

We encourage you to complete your SBA 3508 Loan Forgiveness Application online to ensure a timely and efficient process.

Yes, PPP loans under $50,000 may qualify for automatic forgiveness, simplifying the process for small businesses. However, borrowers must still complete and submit the necessary documentation as specified in the SBA 3508 guidelines. Using the US Legal Forms platform can help guide you through the necessary forms and ensure you meet the eligibility criteria for this automatic forgiveness provision.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.