Get Sba 2483 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 2483 online

The SBA 2483, or Paycheck Protection Program Borrower Application Form, is crucial for businesses seeking financial assistance through the Paycheck Protection Program. This guide will provide clear, step-by-step instructions on how to effectively fill out the form online to ensure a smooth application process.

Follow the steps to complete the SBA 2483 form online.

- Press the ‘Get Form’ button to access the SBA 2483 online, enabling you to fill it out in an intuitive interface.

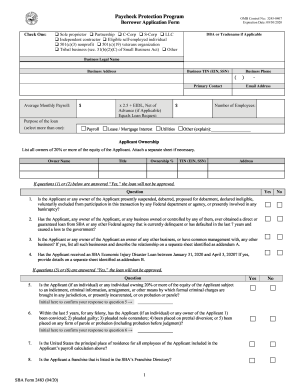

- Select the appropriate check box to indicate your business type, such as sole proprietor, partnership, C-Corp, S-Corp, LLC, independent contractor, or eligible self-employed individual.

- Fill in your business legal name, tradename (if applicable), business address, taxpayer identification number (TIN), and business phone number.

- Provide your primary contact email address for communication regarding your application.

- Calculate your average monthly payroll, using appropriate timeframes unless otherwise specified, and input the result in the designated field. If applicable, include any Economic Injury Disaster Loan amount.

- Select the purpose of the loan by checking all relevant options, such as payroll, mortgage interest, utilities, or other specified needs.

- List all owners who hold 20% or more equity in the business, including their name, title, ownership percentage, TIN, and address. Use a separate sheet if necessary.

- Answer the eligibility questions truthfully. Ensure that all 'Yes' responses do not preclude loan approval.

- Make necessary certifications by initialing next to each statement to confirm compliance and understanding of the provided information.

- Sign the form as the authorized representative, include the date, and print your name and title.

- Review the completed SBA 2483 for accuracy. Once confirmed, save your changes, download the document, print it, or share it as required for submission.

Complete your SBA 2483 and submit your application online to access necessary funding.

The 20% rule for SBA loans generally refers to the requirement that you must have at least 20% equity in the business or assets being financed. This rule helps lenders assess your commitment and investment in the success of your venture. Understanding the 20% rule is crucial when applying for SBA 2483 funding, as it can significantly influence your eligibility.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.