Get Sba 3508s 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SBA 3508S online

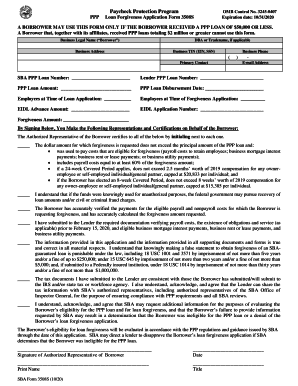

The SBA 3508S form is designed for borrowers who received a Paycheck Protection Program (PPP) loan of $50,000 or less, streamlining the loan forgiveness application process. This guide provides you with a step-by-step approach to successfully fill out the SBA 3508S form online, ensuring you have all necessary information at hand.

Follow the steps to complete the SBA 3508S form online.

- Click ‘Get Form’ button to obtain the SBA 3508S form and open it in your preferred editor.

- Enter the business legal name and any applicable 'Doing Business As' (DBA) or tradename in the designated fields to identify your business.

- Provide your business address, TIN (either EIN or SSN), and business phone number to accurately document your business information.

- Fill in the primary contact’s name and email address to ensure communication regarding your application.

- Input the PPP loan number and lender PPP loan number, which are important for tracking your application.

- Specify the total amount of the PPP loan and the date of disbursement to confirm the financial details.

- Indicate the number of employees at the time of the loan application and at the time of submitting the forgiveness application.

- If applicable, enter the Economic Injury Disaster Loan (EIDL) advance amount and application number.

- Calculate the forgiveness amount you are requesting and enter it in the provided field.

- Review the certification section, where you will need to initial each representation to certify your compliance with the loan forgiveness criteria.

- Sign and date the form as the authorized representative of the borrower, ensuring your printed name and title are provided to finalize your application.

- Once all information is filled out, you can save changes, download, print, or share the SBA 3508S form as needed.

Complete your SBA 3508S form online today to ensure timely processing of your loan forgiveness application.

Get form

Certain loans do not qualify for forgiveness, including those used for ineligible expenses or improper documentation. SBA loans like those for real estate, personal use, or refinancing existing debt typically fall outside the forgiveness criteria. Understanding the limitations is crucial to avoid any financial setbacks. For precise guidance, consider utilizing uslegalforms, which can provide the necessary forms and insights on the SBA 3508S to ensure compliance.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.