Get Nc Smart Start Verification Form For Self Employment Income & Expenses - Davidson County

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC Smart Start Verification Form For Self Employment Income & Expenses - Davidson County online

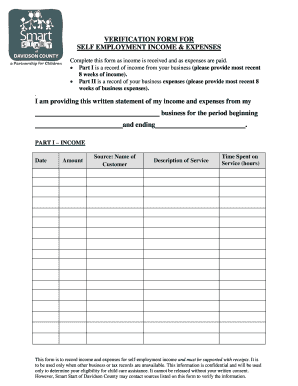

The NC Smart Start Verification Form for self-employment income and expenses is a crucial document for individuals in Davidson County who need to record their business income and expenses. This guide offers a clear and structured approach to completing the form online, ensuring you provide the necessary information accurately.

Follow the steps to complete the NC Smart Start Verification Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin filling out Part I of the form, which focuses on your income. Enter the date, amount received, name of the customer, description of the service provided, and the time spent on that service. Make sure to cover the most recent eight weeks of income.

- If you need more space for additional income entries, continue on the continuation sheet provided in the form. Repeat the same details: date, amount, source, description, and time spent.

- Proceed to Part II of the form to document your business expenses. Here, you will enter the date of the expense, the amount spent, the type of expense incurred, and the name of the company from which the purchase was made. Attach any relevant receipts to support these entries.

- If further entries are needed for expenses, utilize the continuation sheet for Part II and follow the same procedure as before.

- Review all entries for accuracy. Note that all information must be true and complete for the period indicated.

- Sign the form to certify that the information provided is accurate. Ensure that the date is also entered next to your signature.

- Once all sections are filled out and reviewed, you can save any changes made to the document, download the form for your records, print a hard copy, or share it as needed.

Complete your NC Smart Start Verification Form online today to ensure your eligibility for child care assistance.

Related links form

To add self-employment income, you should refer to the NC Smart Start Verification Form For Self Employment Income & Expenses - Davidson County. This form allows you to document your earnings effectively. Input your total income from all self-employment activities in the designated section, ensuring accuracy to reflect your financial situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.