Get Vehicle Excise Abatement Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vehicle Excise Abatement Application Form online

Completing the Vehicle Excise Abatement Application Form online can seem complex, but this guide provides clear and supportive instructions to help you through the process. By following the steps outlined below, you will be able to fill out the form with confidence.

Follow the steps to complete the application form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

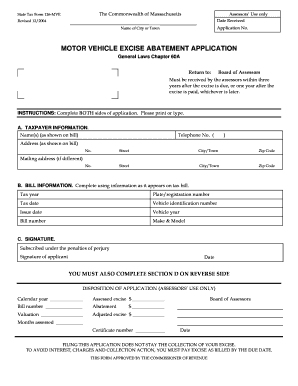

- Begin by filling out section A, TAXPAYER INFORMATION. Input your name as it appears on the tax bill, your telephone number, and your address. Ensure the information matches the details on your tax bill.

- Next, proceed to section B, BILL INFORMATION. Enter the tax year, plate or registration number, tax date, vehicle identification number (VIN), issue date, vehicle year, bill number, and make and model of the vehicle. Use the information displayed on your tax bill for accuracy.

- In section C, SIGNATURE, sign the application to certify that the information is true under penalties of perjury. Include the date of your signature.

- Turn to section D, REASON(S) FOR ABATEMENT SOUGHT. Check the reasons that apply to your situation and provide the required documentation specified next to each reason. Ensure you include all necessary documents to support your request.

- Review all sections to ensure that all information is complete and accurate. Double-check the documentation to confirm it aligns with your stated reasons for abatement.

- Save your changes, and if applicable, download or print the completed form for submission. Ensure you follow all submission guidelines as per the requirements of your local Board of Assessors.

Complete your Vehicle Excise Abatement Application Form online today to ensure you meet all necessary deadlines.

To file an abatement for excise tax in Massachusetts, you'll need to complete the Vehicle Excise Abatement Application Form accurately. This form requires details about your vehicle and the basis for your claim, such as changes in ownership or valuation. After submitting your application to the local tax assessor, monitor its status and follow up if needed. This proactive approach can help ensure you receive a fair evaluation of your tax situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.