Get Consumer Lending Forms Description

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Consumer Lending Forms Description online

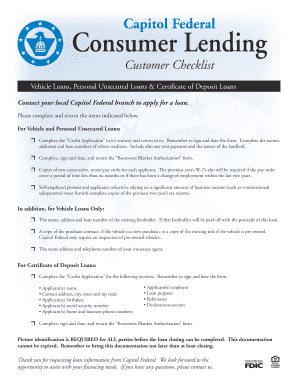

Completing the Consumer Lending Forms online is an important step in the application process for vehicle loans, personal unsecured loans, or certificate of deposit loans. This guide will provide clear and supportive instructions to help you fill out the required forms accurately and efficiently.

Follow the steps to complete your Consumer Lending Forms

- Click ‘Get Form’ button to access the Consumer Lending Forms Description and open it in your chosen editor.

- Fill out the ‘Credit Application’ form in its entirety, ensuring you provide your name, address, and any loan details. Make sure to sign and date the form before submission.

- Complete the ‘Borrowers Blanket Authorization’ form. This document must also be signed and dated before returning it.

- For vehicle and unsecured personal loans, attach copies of two recent consecutive pay stubs for each applicant. If the pay stubs do not cover six months or if there has been recent employment changes, include the previous year’s W-2 forms.

- If you are self-employed or relying significantly on business income, provide complete copies of your tax returns for the previous two years.

- For vehicle loans, include the name, address, and loan number of any existing lienholder, and specify if this lienholder will be paid off with the loan proceeds.

- If purchasing a new vehicle, include a copy of the purchase contract; for pre-owned vehicles, attach a copy of the existing title. Be aware that an inspection may be required for pre-owned vehicles.

- Provide the name, address, and telephone number of your insurance agent to complete the requirements for vehicle loans.

- For certificate of deposit loans, fill out the relevant sections in the ‘Credit Application,’ including your name, address, birthdate, social security number, contact numbers, employer details, loan purpose, references, and declarations. Remember to sign and date this form as well.

- Finally, ensure that all necessary picture identification is prepared for all parties involved, as this documentation must be presented before loan closing.

- Once all sections are completed, save your changes, and choose to download, print, or share the completed form as needed.

Take the next step in your financing journey by completing your Consumer Lending Forms online today.

Yes, filing a complaint with the Consumer Financial Protection Bureau (CFPB) can lead to meaningful action. The CFPB reviews complaints to identify trends and can take steps to address systemic issues in the lending industry. If you believe you're facing unfair lending practices, engaging with the CFPB can be a proactive step, and utilizing the Consumer Lending Forms Description can help you articulate your concerns clearly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.