Loading

Get Printable Form To Balance Check Book

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Printable Form To Balance Check Book online

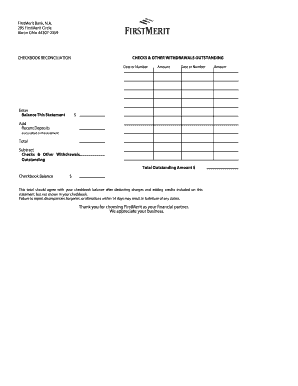

Balancing a checkbook is an essential task for effective financial management. This guide provides comprehensive instructions on how to accurately fill out the Printable Form To Balance Check Book online, ensuring that you maintain clarity in your banking records.

Follow the steps to fill out your checkbook reconciliation form effectively.

- Click the ‘Get Form’ button to obtain the form and open it in your online editor.

- Begin by entering the date or check number for the transaction you wish to review. This information should reflect the date of the check or the transaction number for accuracy.

- Next, provide the balance amount shown on your latest bank statement in the section labeled 'Balance This Statement'. This is the total amount in your account as of the statement date.

- Move on to 'Add Recent Deposits (not credited on this statement)'. Here, enter any recent deposits that you have made which may not yet be reflected in the statement. This ensures you have a complete picture of your balance.

- After entering deposits, subtract any 'Checks & Other Withdrawals Outstanding'. Fill in the amounts for any checks you have written or withdrawals that have not yet cleared your bank.

- Calculate the 'Total Outstanding Amount'. This is the sum of any outstanding checks or withdrawals as well as any credits you have added from your recent deposits.

- Finally, report the 'Checkbook Balance'. This number represents your running balance after all deductions and additions. Ensure that this total matches your records to avoid discrepancies.

- Once completed, make sure to save changes to your document. You can then download, print, or share the form as required.

Start outlining your financial peace of mind by completing your documents online today.

To reconcile your check register with a bank statement, start by comparing the two for discrepancies. Identify and record outstanding checks and deposits that have not cleared. Using a printable form to balance your check book can help facilitate this reconciliation process more efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.