Loading

Get Loss Payee

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loss Payee online

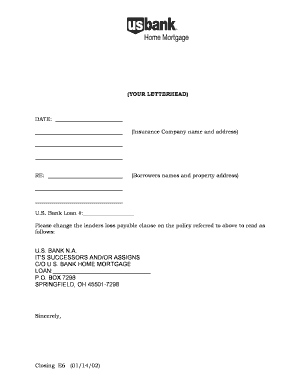

The Loss Payee form is an important document used to designate a lender as a recipient of insurance proceeds in the event of a loss. Properly completing this form ensures that your lender is legally recognized in your insurance policy.

Follow the steps to accurately complete the Loss Payee form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully enter the date at the top of the form to indicate when the request is being made.

- Fill in the name and address of the insurance company, ensuring that all details are accurate to avoid any complications.

- In the Re: section, include the names of the borrowers and the property address to clearly identify the policy in question.

- Enter the U.S. Bank Loan number in the designated field. This number is essential for correlating the insurance policy with the loan.

- In the clause section, replace the existing text with the following: ‘U.S. BANK N.A. IT'S SUCCESSORS AND/OR ASSIGNS C/O U.S. BANK HOME MORTGAGE LOAN:______________________________ P.O. BOX 7298 SPRINGFIELD, OH 45501-7298’. Ensure to fill in the loan number accurately where indicated.

- Conclude the document by signing it with your name, followed by the title as Closing E6, dated January 14, 2002.

- Once all fields have been completed, review the form for accuracy. Save your changes, and then you can choose to download, print, or share the form as needed.

Complete your Loss Payee document online for a smooth process.

Adding a loss payee means including a third party in your insurance policy who will receive payment directly in the event of a loss. This addition typically protects the interests of lenders or financial institutions involved in a secured transaction. You should review your policy terms to clarify how this affects your coverage.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.