Get Predatory Lending Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Predatory Lending Worksheet online

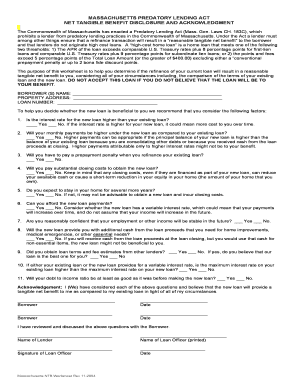

The Predatory Lending Worksheet is an essential tool designed to help borrowers evaluate whether refinancing their current loan will result in a tangible net benefit. This guide provides clear, step-by-step instructions for completing the worksheet online, ensuring you understand each component of the form effectively.

Follow the steps to successfully complete the worksheet online.

- Press the ‘Get Form’ button to access the Predatory Lending Worksheet and open it in your preferred editor.

- Enter the names of the borrowers in the designated field marked 'BORROWER(S) NAME'.

- Fill in the 'PROPERTY ADDRESS' where the property related to the loan is located.

- Input the 'LOAN NUMBER' for your existing loan in the corresponding space.

- Carefully assess each question listed on the worksheet and mark 'Yes' or 'No' based on your circumstances, providing thoughtful responses.

- Revisit each question to ensure clarity and accuracy in your answers, reflecting on how they relate to your financial situation.

- In the acknowledgement section, confirm that you have considered all provided questions and believe that the new loan will deliver a tangible net benefit.

- Sign and date where indicated for each borrower, ensuring that both parties acknowledge the information provided.

- In the section for the lender, fill in the name of the lender and loan officer, and ensure all signatures are duly provided along with the date.

- After completing the form, save your changes, and consider downloading or printing the worksheet for your records.

Begin filling out your Predatory Lending Worksheet online today to ensure you make an informed decision about your loan.

Predatory lending practices can also be referred to as exploitative lending or abusive lending. These terms highlight the harmful intent and tactics used by lenders to take advantage of vulnerable borrowers. Understanding these alternative terms can help you identify these practices more effectively, especially when using resources like a Predatory Lending Worksheet.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.