Loading

Get Qdia Reenrollment Notice Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Qdia Reenrollment Notice Form online

Filling out the Qdia Reenrollment Notice Form online can be a straightforward process if you follow the right steps. This guide will walk you through each section of the form, ensuring that you provide the necessary information accurately and confidently.

Follow the steps to complete your Qdia reenrollment notice form online.

- Click the ‘Get Form’ button to obtain the form and open it in the document editor.

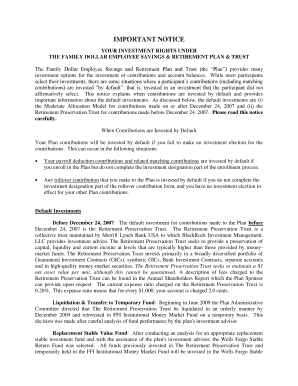

- Begin by reviewing the introduction section of the form, which outlines the purpose of the Qdia Reenrollment Notice Form. Familiarize yourself with the terms and relevant dates mentioned in the document.

- Proceed to the personal information section. Fill in your full name, address, and contact details as required. Ensure that the information entered is accurate to avoid any issues with your enrollment.

- Next, you will need to review and select your investment options. The form may provide sections to indicate your preferred investment choices. Carefully assess the options available and choose the ones that fit your financial goals.

- If applicable, follow the prompts to enter any rollover contributions. Make sure to complete the investment designation part as required to avoid default investments.

- Once all sections of the form are filled out, review your entries to ensure everything is correct. Check for any missing fields or errors.

- Finally, save your changes if the option is available. You may choose to download, print, or share the form as needed to ensure it is submitted according to your plan’s requirements.

Complete your Qdia Reenrollment Notice Form online today to secure your investment options.

A 404a5 notice is a required disclosure that provides participants with information about their retirement plan's fees and expenses. This notice aims to enhance transparency and help participants make informed decisions regarding their investments. Familiarity with the Qdia Reenrollment Notice Form can bridge understanding of these related topics.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.