Loading

Get Fidelity Ein Simple Ira Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fidelity Ein Simple Ira Form online

Filling out the Fidelity Ein Simple IRA Form online can be a straightforward process when you understand each section of the form. This guide provides detailed, step-by-step instructions to help users of all experience levels effectively complete the form.

Follow the steps to accurately complete the Fidelity Ein Simple Ira Form.

- Click the ‘Get Form’ button to access the Fidelity Ein Simple IRA Form and open it in your preferred editor.

- Read the fidelity course disclosures carefully to understand the terms related to the IRA you are establishing.

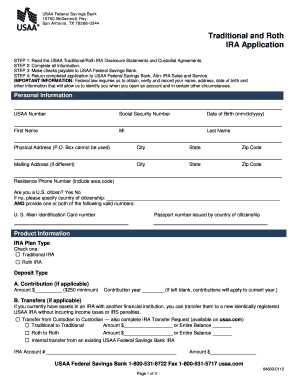

- Provide your personal information, including your full name, physical address, and social security number.

- Select the appropriate IRA plan type by checking either the Traditional IRA or Roth IRA box.

- Fill in the Deposit Type section by indicating whether you are making a contribution, transfer, or rollover.

- If making an initial deposit, specify the amount and choose the method of payment, either by check, transfer, or debit.

- Provide beneficiary information, including names, social security numbers, and percentage distribution if applicable.

- Carefully review your entries for accuracy before signing the form at the designated area.

- Submit the completed form as instructed, ensuring that you have included all necessary documentation.

- After submission, consider saving changes, downloading a copy, or printing the form for your records.

Start filling out your Fidelity Ein Simple IRA Form online today to take your first step toward retirement savings.

Fidelity provides a variety of IRA options, including Traditional IRAs, Roth IRAs, and SIMPLE IRAs. Each type offers distinct tax advantages suited for different investment and retirement strategies. By selecting the right kind of IRA, such as the Fidelity Ein Simple Ira Form, you can maximize your savings and benefits efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.