Loading

Get Form Txr 01

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Txr 01 online

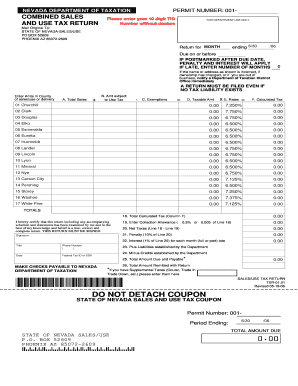

This guide provides a detailed overview of how to accurately complete the Form Txr 01, the combined sales and use tax return for Nevada. Follow the instructions step by step to ensure your form is properly submitted online.

Follow the steps to fill out the Form Txr 01 successfully.

- Click 'Get Form' button to access the form and open it in your preferred online editor.

- Enter your 10-digit TID number without dashes in the designated field at the top of the form.

- If the name or address is incorrect, or if ownership has changed, notify the Department of Taxation immediately.

- In the 'Total Sales' section, input the total amount of all sales related to your Nevada business for the reporting month. Ensure that sales tax collected is not included.

- In the 'Amount subject to Use Tax' section, enter the purchase price of any merchandise purchased without Nevada sales tax.

- In 'Exemptions', provide the amount of sales that are exempt from tax.

- Calculate the 'Taxable Amount' by taking the total sales, adding the amount subject to use tax, and subtracting the exemptions.

- In the 'Calculated Tax' field, multiply the taxable amount by the applicable tax rate for each county.

- Complete the sections regarding collection allowance, net taxes, penalties, interest, and any prior reporting amounts.

- Verify that all calculations are accurate before finalizing your form.

- Sign and date the form to certify its accuracy, ensuring that all required information is included.

- After reviewing your entries, save the changes, then download, print, or share the form as needed.

Complete your Form Txr 01 online today to ensure timely submission and avoid penalties.

Filling out an expense reimbursement form involves documenting your expenses accurately. Begin by indicating your personal details and then itemize every relevant expense, attaching necessary receipts. Using the Form Txr 01 helps ensure all required information is collected and submitted, making the reimbursement process easier for everyone involved.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.