Loading

Get Roth Ira Designation Or Change Of Beneficiary Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Roth Ira Designation Or Change Of Beneficiary Form online

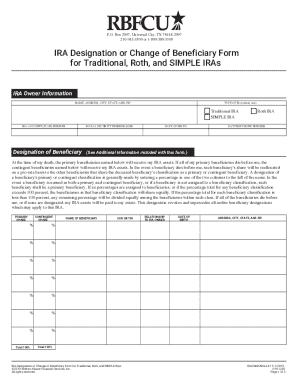

Filling out the Roth IRA Designation or Change of Beneficiary Form online is an important step in managing your retirement assets. This guide will walk you through each section of the form to ensure that you complete it accurately and effectively.

Follow the steps to fill out the form online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information in the designated fields. This typically includes your full name, address, and Social Security number. Ensure that all entries are accurate to avoid any processing delays.

- Next, identify the beneficiary or beneficiaries you wish to designate. This section may require you to provide their full names, relationships to you, and possibly their Social Security numbers.

- Specify the percentage of your Roth IRA that each beneficiary will receive. Make sure that the total adds up to 100% for clarity.

- Review the choices you have made to ensure they reflect your intentions accurately. Check each detail for correctness before proceeding.

- Once you are satisfied with the entries, proceed to sign the form electronically. Some forms may require you to date your signature as well.

- Save your changes, and if needed, download, print, or share the form as directed. Ensure you keep a copy for your records.

Complete your Roth IRA designations online today for peace of mind.

An IRA beneficiary form is a document that permits account holders to designate who will inherit their IRA assets after death. This form is essential for guiding the transfer of funds without going through probate. Completing a Roth IRA designation or change of beneficiary form ensures your wishes are met and your beneficiaries can access funds without complications. Keep this form updated as your life situation changes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.