Get Pacific Life Simple Ira Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pacific Life Simple IRA form online

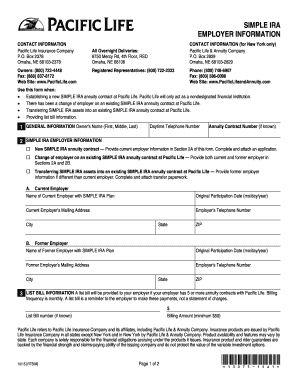

Filling out the Pacific Life Simple IRA form online is a crucial step for those establishing or managing their SIMPLE IRA annuity contracts. This guide provides clear and detailed instructions to help users navigate the form efficiently, ensuring a smooth process.

Follow the steps to complete the Pacific Life Simple IRA form.

- To obtain the form, click the ‘Get Form’ button to access it in the online editor.

- Begin by providing the general information. Enter the owner's name, including first, middle, and last names, daytime telephone number, and any applicable annuity contract number.

- For the SIMPLE IRA employer information section, indicate the nature of the form by checking one of the following boxes: 1) New SIMPLE IRA annuity contract, 2) Change of employer on an existing SIMPLE IRA contract, or 3) Transfer of SIMPLE IRA assets. Complete both Sections 2A and 2B as necessary.

- In Section 2A, enter the current employer's name along with the original participation date, mailing address, and contact number.

- If applicable, provide the former employer's information in Section 2B by entering their name, original participation date, mailing address, and contact number.

- For the list bill information, check if a list bill will be provided. If so, enter the list bill number (if known) and the billing amount, ensuring it meets the minimum requirement of $50.

- In the signature and certification section, the owner must sign and date the form, confirming they have read and accepted the provisions of the document.

- After completing the form, save any changes, and choose to download, print, or share the form as needed.

Start filling out your Pacific Life Simple IRA form online today to ensure your retirement savings are properly managed.

Converting a SIMPLE IRA to a 401(k) can be a strategic move for your retirement planning. You will need to ensure that you have completed at least two years of participation in the SIMPLE IRA plan. It's also crucial to follow proper procedures, which may involve paperwork and approvals from your 401(k) provider. Utilizing the Pacific Life Simple IRA form can ease the transition and provide clear documentation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.