Loading

Get Wage Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wage Statement online

Completing the Wage Statement online can be a straightforward process if you follow the appropriate steps. This guide will provide you with detailed, user-friendly instructions to help ensure your form is filled out correctly and submitted on time.

Follow the steps to complete your Wage Statement online

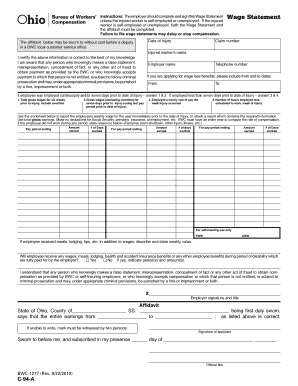

- Click ‘Get Form’ button to access the Wage Statement and open it in your online editor.

- Enter the date of injury in the designated field to document when the incident occurred.

- Fill in the claim number associated with the worker’s compensation claim.

- Provide the injured worker's name and telephone number for communication purposes.

- Enter the employer name to identify the organization responsible for the injured employee.

- If applying for wage loss benefits, input the 'From' and 'To' dates to specify the period being claimed.

- For employees employed continuously or seven days prior to the date of injury, complete questions 1 and 2 regarding total gross wages and gross wages for the last pay period.

- If the employee was employed for less than seven days prior to the injury, answer questions 3 and 4 regarding the hourly pay rate and the number of scheduled work hours in the week of injury.

- Use the worksheet provided to report the employee's weekly earnings for the year prior to the injury, attaching any additional reports as necessary.

- If the employee did not work during any period, note the reasons for absence in the specified section.

- Indicate any additional benefits received by the employee during the disability period, and whether they will continue to receive any wages or benefits fully paid for by the employer.

- Ensure the employer signs and dates the form, confirming the accuracy of the information provided.

- Complete the affidavit section, ensuring that the information is sworn and verified, then sign where indicated.

- After filling out the form, save your changes and select the option to download, print, or share the Wage Statement as needed.

Begin your Wage Statement process online today and ensure your compensation claims are filed accurately.

To report wages to the IRS, you need to ensure that your wage statement accurately reflects your earnings. Employers typically report this information on Form W-2, which you should receive by January 31 each year. If you are self-employed or have additional income, you may need to report this on Schedule C or other relevant forms. Keeping detailed records helps ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.