Loading

Get Rrif

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RRIF online

Filling out the RRIF form online can streamline your cash withdrawal process. This guide provides clear, step-by-step instructions to help you navigate the form with ease.

Follow the steps to complete your RRIF form online.

- Press the ‘Get Form’ button to acquire the RRIF document and open it for editing.

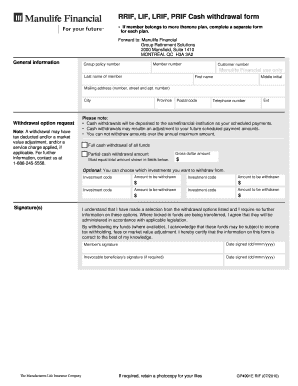

- Begin with the general information section. Fill in your member number, group policy number, and customer number accurately. Provide your last name, first name, and middle initial.

- Complete your mailing address by entering the number, street, and apartment number. Also, provide the city, province, postal code, and your telephone number, including the extension if applicable.

- In the withdrawal option request section, read carefully as it explains potential tax deductions and service charges. Select your desired withdrawal option, either a full cash withdrawal or a partial cash withdrawal.

- If opting for a partial withdrawal, specify the gross dollar amount you wish to withdraw, ensuring it matches the total amount shown. Additionally, indicate which investments you are withdrawing from by entering the investment codes and the respective amounts.

- Sign the document, acknowledging your selections and understanding of the tax implications. If required, have the irrevocable beneficiary sign and date the form.

- Once completed, save your changes. You can download, print, or share the form as needed.

Complete your RRIF form online today with confidence!

To create a RRIF, you’ll need to contact a financial institution and provide details about your RRSP. They will guide you through the conversion process, ensuring you understand withdrawal requirements and tax implications. It's essential to select a reputable institution that aligns with your financial goals. U.S. Legal Forms can provide necessary forms and instructions to streamline the creation of your RRIF.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.