Get Form 4810 Mailing Address

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4810 Mailing Address online

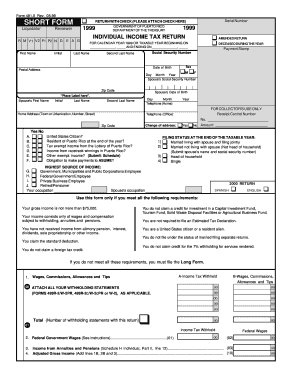

Filling out Form 4810 is essential for individuals in Puerto Rico who need to report their income for taxation purposes. This guide provides a step-by-step approach to help users complete the form accurately and efficiently online.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to retrieve the form and access it in your preferred online editor.

- Begin by entering your first name followed by your initial in the designated fields. Ensure that the information is accurate as it will be used to identify you.

- Next, input your last name and your second last name, if applicable. It is important to provide your full name as it appears on your official identification.

- Enter your Social Security Number in the specified field. This is crucial for tax identification and processing.

- Fill out the date of birth section using the correct format (Day, Month, Year). This assists in confirming your age eligibility for certain tax considerations.

- Complete the postal address section. Include your home address, building number, street, town or urbanization, and zip code. This information is necessary for correspondence and potential refunds.

- Indicate your filing status at the end of the taxable year by selecting the appropriate check box for married, single, head of household, or other applicable statuses.

- Provide necessary details regarding your spouse, if applicable, including their name, Social Security Number, and date of birth.

- Respond to the questions related to your income sources, citizenship status, and any exemptions. This is crucial for determining your tax obligations.

- Once you have completed all sections, review your entries for accuracy. Save your changes, and then utilize the options available to download, print, or share the form as needed.

Complete your forms online today to ensure timely and accurate tax filing.

Form 5471 and Form 8621 serve different purposes in reporting international investments. Form 5471 is used to report information about foreign corporations you control, while Form 8621 relates specifically to Passive Foreign Investment Companies. Understanding the distinctions is crucial for accurate tax reporting and compliance. To clarify these requirements further, explore resources on uslegalforms that explain these forms in-depth, including the relevant Form 4810 Mailing Address.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.