Get State Of Wyoming Liquor Commission Monthly Excise Report Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Of Wyoming Liquor Commission Monthly Excise Report Form online

This guide provides clear and detailed instructions for completing the State Of Wyoming Liquor Commission Monthly Excise Report Form online. Whether you are a seasoned microbrewer or new to the process, this step-by-step approach will help ensure that you accurately fill out the required information.

Follow the steps to complete the Monthly Excise Report Form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

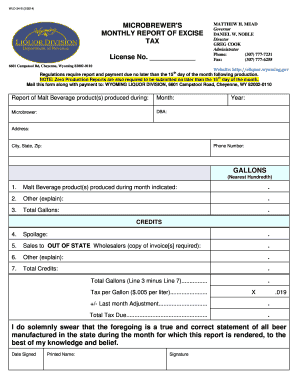

- Begin by entering your license number in the designated field at the top of the form. This identifies your microbrewery for record-keeping.

- Fill in the month and year for which you are reporting. This ensures the report is correctly associated with your production period.

- Provide your microbrewery name and ‘doing business as’ (DBA) name as appropriate. Include your complete address, city, state, and zip code to validate your business location.

- List the gallons of malt beverage product(s) produced during the indicated month. Enter the total in the nearest hundredth for precision.

- If applicable, provide details for any other production declared in the ‘Other’ field and summarize the total gallons produced.

- In the credits section, report any spoilage or sales to out-of-state wholesalers, with required documentation attached. Detail any other credits in the respective fields.

- Calculate the total gallons by subtracting total credits from the total gallons produced. Enter this in the designated field.

- Determine the tax due by applying the tax rate to the total gallons. Be sure to make any necessary adjustments from last month and enter the final total tax due.

- Sign and date the report, ensuring you print your name clearly. This certifies that the information provided is correct to the best of your knowledge.

- Once the form is complete, you can save your changes, download the report, print it, or share it as needed.

Complete your State Of Wyoming Liquor Commission Monthly Excise Report Form online today to ensure compliance and timely submission.

Yes, if your business is subject to state taxes, you must file a state tax return in Wyoming. This applies to various taxes, including income, sales, and liquor taxes. Each tax type may have its own filing requirements, so be sure to review those specifics. Using the State Of Wyoming Liquor Commission Monthly Excise Report Form helps simplify the process for liquor-related transactions and ensures that you remain compliant.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.