Get Wv Board Of Accountancy Cpe Reporting Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wv Board Of Accountancy Cpe Reporting Form online

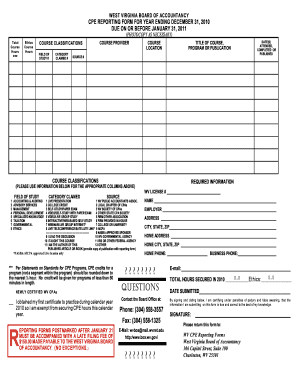

This guide provides clear and detailed instructions on how to properly complete the Wv Board Of Accountancy Cpe Reporting Form online. It is designed to assist users of all experience levels in accurately reporting their continuing professional education hours.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to access the reporting form and open it in your preferred editor.

- Begin by entering your Wv license number in the designated field to ensure your report is correctly associated with your profile.

- In the 'Total Course Hours' section, input the overall number of course hours you completed during the reporting period. Make sure to include Ethics course hours if applicable.

- For each course completed, provide the required details, including the title of the course, the course provider, and the location where the course was held. Make sure to record the dates you attended or completed the course.

- Fill out the 'Field of Study #' and 'Category Claimed #' corresponding to each course as indicated on the form. This helps categorize the courses based on your professional development.

- Report the source of each course, selecting from the provided options such as live presentations or self-study formats.

- After completing all sections of the form, review your entries for accuracy to avoid potential issues with your submission.

- Finally, save your changes, and choose to download a copy of the form, print it for records, or share it if required.

Complete your Cpe Reporting Form online today to ensure timely submission and compliance.

The Virginia Board of Accountancy mandates that CPAs complete 120 hours of continuing professional education every three years. At least 20 of those hours must be earned each year, including specific requirements in ethics education. Staying informed about these CPE requirements is crucial for CPA compliance and professional growth, and tools like the WV Board Of Accountancy Cpe Reporting Form can help you manage your education effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.