Get Washington Department Of Revenue Inheritance Tax Division

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Washington Department Of Revenue Inheritance Tax Division online

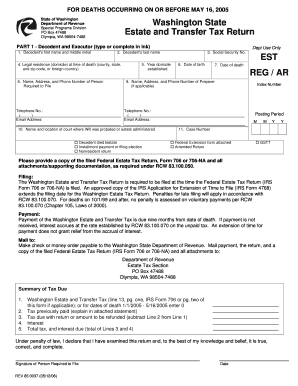

Filling out the Washington Estate and Transfer Tax Return is an important step for the estate of a deceased person. This guide provides clear and comprehensive instructions to assist you in completing the necessary form accurately and efficiently.

Follow the steps to complete the Washington Estate and Transfer Tax Return online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred application for editing.

- Begin filling out Part 1 of the form, which includes information about the decedent and the executor. Enter the decedent's first and last name, social security number, date of birth, and date of death. Ensure that all information is correct and clearly typed or filled in ink.

- Provide the legal residence of the decedent at the time of death, including the county, state, and zip code or foreign country. This information is crucial for determining the applicable tax jurisdiction.

- Input the contact details of the person required to file, including their address and telephone number. If there is a preparer involved, include their contact information as well.

- Indicate the name and location of the court where the will was probated or the estate was administered. If applicable, check the appropriate boxes for testate status and other relevancies such as installment payment elections.

- Complete the summary of tax due by entering the Washington Estate and Transfer Tax amount from the Federal Estate Tax Return, along with any tax previously paid, interest, and totals per the instructions provided.

- Lastly, declare your statement of accuracy by signing the form. Ensure to date your signature appropriately.

- Save your changes to the document. You can choose to download, print, or share the form as needed for submission.

Complete your Washington Estate and Transfer Tax Return online today for a smooth filing experience.

No, you do not have to report your inheritance to the state of Washington, as there is no inheritance tax requirement. However, if your inheritance generates income or you sell inherited property, you may have to report that income on your federal taxes. To ensure compliance and understand your responsibilities, utilizing resources from the Washington Department Of Revenue Inheritance Tax Division is advisable.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.