Get Form R 3

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form R 3 online

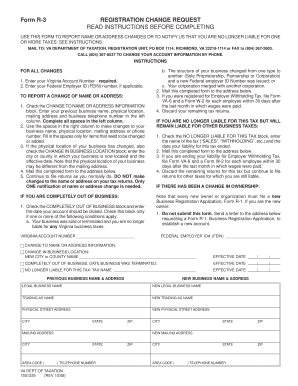

Form R 3 is a registration change request form used to report changes in name, address, or liability for Virginia state taxes. This guide will provide you with clear and detailed instructions on how to fill out this form online, ensuring a smooth submission process.

Follow the steps to successfully complete the Form R 3 online.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your Virginia Account Number in the designated field; this is a required step.

- If applicable, input your Federal Employer ID (FEIN) number.

- To report a change of name or address, check the box labeled 'CHANGE TO NAME OR ADDRESS INFORMATION.' Fill in your previous business name, physical location, mailing address, and business telephone number in the left column.

- Use the right column spaces to enter the new business name, physical location, mailing address, or phone number, but only for items that need to be changed.

- If your business location has changed, check the 'CHANGE IN BUSINESS LOCATION' box, and enter the current city or county where your business is located along with the effective date of the change.

- After completing the form, review all entries for accuracy and completeness before proceeding.

- To submit the form, you can download, print, or save your completed Form R 3 and mail it to the Virginia Department of Taxation at the address specified: PO Box 1114, Richmond, VA 23218-1114. You may also choose to fax it to (804) 367-2603.

Complete and submit your Form R 3 online to ensure your registration changes are processed efficiently.

Filing Form 3CB requires you to complete an online form that details your business income and expenses. First, gather all necessary financial records and ensure they are accurate. Access the relevant online platform, fill in the details, and submit your form. Platforms like uslegalforms provide guidance to simplify such processes, making it easier to ensure compliance with Form R 3.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.