Loading

Get Vermont Hs 122w Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vermont Hs 122w Form online

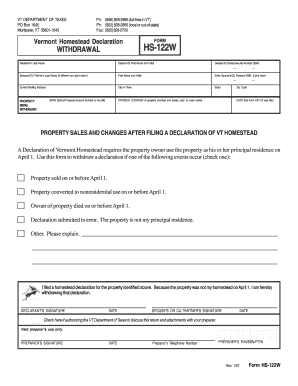

The Vermont Hs 122w Form is essential for withdrawing a homestead declaration. This guide will help you navigate the process of filling out this form online with clarity and ease.

Follow the steps to successfully complete the Vermont Hs 122w Form.

- Press the ‘Get Form’ button to access the Vermont Hs 122w Form and open it in your chosen editor.

- Begin by filling in the declarant’s last name, first name, and initial. Ensure accuracy to avoid any processing delays.

- Enter the declarant’s Social Security Number (SSN). This is crucial for identification purposes.

- If applicable, provide the spouse’s or civil union partner’s last name, first name, and initial. If it is a joint return, also include their SSN.

- Complete the current mailing address section. Include the city or town, state, and zip code for correct correspondence.

- Next, specify the physical location of the property being withdrawn, detailing the number and street, road, or route name.

- Enter the School Property Account Number (SPAN) as listed on your tax bill.

- Indicate the date that the original Form Hs-122 was filed to keep records aligned.

- In the section regarding property sales and changes, select one of the provided events that apply to your situation.

- If other, provide a detailed explanation in the space provided.

- Affirm your declaration by signing in the space designated for the declarant's signature, along with the date.

- If applicable, have your spouse or civil union partner sign and date the form as well.

- If you are authorizing the Vermont Department of Taxes to discuss this return with your preparer, check the corresponding box.

- Lastly, if applicable, the preparer should sign, date, and include their telephone number and EIN/SSN/PTIN in the provided fields.

- Once all sections are completed, you can save your changes, download, print, or share the form as needed.

Complete your Vermont Hs 122w Form online today for a smooth withdrawal process!

Non-residents in Vermont may be subject to property tax on any real estate they own in the state. This includes taxes on rental properties or second homes. To ensure you meet your tax obligations, it's helpful to review the relevant forms, including the Vermont Hs 122w Form, which may be necessary for any property owned.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.