Loading

Get Homestead Declaration And Property Tax Adjustment Form Hs-122 ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Homestead Declaration and Property Tax Adjustment FORM HS-122 online

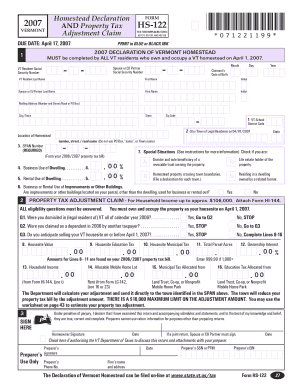

Filling out the Homestead Declaration and Property Tax Adjustment FORM HS-122 is essential for Vermont residents who own and occupy a homestead. This guide provides clear, step-by-step instructions to help you complete the form online with ease and confidence.

Follow the steps to successfully complete the form.

- Click the ‘Get Form’ button to obtain the form and open it in your editing platform.

- In the first section, enter your Vermont resident social security number, followed by your last name, first name, and middle initial. If applicable, also input the social security number and name of your spouse or civil union partner.

- Provide your mailing address, including street or road name, city or town, state, and zip code.

- Enter your Vermont school district code, the city or town of legal residence on April 1, 2007, and the physical address of your homestead, avoiding P.O. Box or generic terms.

- Input your SPAN (School Property Account Number), which is necessary to identify your property.

- Indicate if there is any business or rental use of your dwelling and check the appropriate boxes for any special situations that apply to your case.

- In the property tax adjustment section, answer all eligibility questions regarding your domicile status and household income. Ensure your household income is within the specified limit.

- Complete the property tax calculations by filling in the amounts from your previous year’s property tax bill, including housesite value, education tax, municipal tax, and total parcel acres.

- Sign and date the form, making sure both parties sign if it is a joint filing. If you used a preparer, include their details as necessary.

- After completing the form, save your changes, and choose an option to download, print, or share the form as needed.

Complete your Homestead Declaration and Property Tax Adjustment FORM HS-122 online today to ensure you meet all filing requirements.

The main form used to claim a property tax credit in Vermont is the Homestead Declaration And Property Tax Adjustment FORM HS-122. This form allows eligible homeowners to declare their homesteads and apply for the corresponding tax benefits. Completing this form accurately can lead to reductions in property tax liabilities and increased financial relief.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.