Loading

Get Vermont Captive Insurance Premium Tax Return Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vermont Captive Insurance Premium Tax Return Form online

This guide provides clear instructions on how to complete the Vermont Captive Insurance Premium Tax Return Form online. By following these steps, users can efficiently navigate the form and fulfill their tax obligations with confidence.

Follow the steps to complete the Vermont Captive Insurance Premium Tax Return Form online.

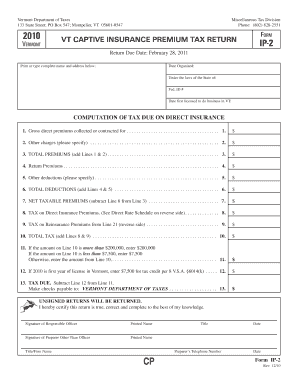

- Press the ‘Get Form’ button to access the Vermont Captive Insurance Premium Tax Return Form and open it in your preferred editor.

- Begin filling out the form by entering your complete name and address in the designated fields.

- Indicate the date your company was organized and specify the state under which the company operates.

- Fill in your Federal ID number and the date your business was first licensed to operate in Vermont.

- Calculate the gross direct premiums collected or contracted for and enter this amount in Line 1.

- If applicable, enter any other charges related to the premiums on Line 2.

- Add Lines 1 and 2 to get the total premiums and record this figure on Line 3.

- Input any return premiums in Line 4 and other deductions in Line 5.

- Total the deductions by adding Lines 4 and 5, and enter the result on Line 6.

- Calculate the net taxable premiums by subtracting Line 6 from Line 3 and enter this on Line 7.

- Determine the tax due on direct insurance premiums according to the tax rate schedule and enter this amount on Line 8.

- Input the tax on reinsurance premiums from Line 21 on the appropriate line.

- Add Lines 8 and 9 to calculate the total tax owed and enter this figure on Line 10.

- If the amount on Line 10 exceeds $200,000, enter $200,000. If it’s less than $7,500, enter $7,500. Otherwise, enter the amount from Line 10 on Line 11.

- If this is your first year of being licensed in Vermont, enter $7,500 for tax credit on Line 12.

- Subtract Line 12 from Line 11 to determine the tax due and enter this in Line 13.

- Ensure you sign the form where indicated and provide the printed name of the responsible officer.

- If a preparer other than the officer assisted in filling out the form, they must also sign and provide their details.

- Once completed, save your changes, download or print the form, and share it as necessary.

Complete your Vermont Captive Insurance Premium Tax Return Form online today!

You can contact the Vermont Department of Taxes through their official website or by phone. They offer various resources and contact methods to assist taxpayers. If you have questions about the Vermont Captive Insurance Premium Tax Return Form, reaching out to them can provide you with the necessary guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.