Loading

Get Hs131

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hs131 online

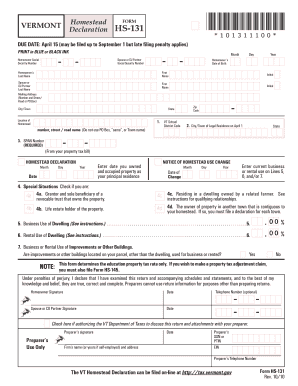

The Hs131 form is essential for Vermont residents to declare their homestead for tax purposes. Filing this declaration ensures that your property is taxed at the appropriate homestead school property tax rate.

Follow the steps to complete your Hs131 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the homeowner's social security number in the designated field. If applicable, include the social security number of your spouse or civil union partner.

- Provide the homeowner's date of birth by entering the month, day, and year in the specified format.

- Fill in the homeowner's last name, first name, and middle initial. Similarly, complete the fields for the spouse or civil union partner.

- Input your mailing address, including street number, street name, or PO Box, along with the city/town, state, and zip code.

- State the physical location of the homestead with the number, street or road name. Avoid using PO Box, 'same', or town name.

- Enter the 3-digit Vermont school district code based on where you lived on April 1. This can usually be found on your property tax bill.

- Indicate your city or town of legal residence on April 1, ensuring clarity if there is both a city and town with the same name.

- Provide the SPAN number from your property tax bill.

- Fill in the date you began occupying the property as your principal residence.

- Check any relevant special situations that apply to your circumstances.

- Indicate the percentage of the dwelling used for business and rental purposes, using whole numbers rounded appropriately.

- Determine if any improvements or other buildings on your property are used for business or rent, checking the appropriate box.

- Sign and date the form. If applicable, provide your daytime telephone number.

- If you wish to authorize the Vermont Department of Taxes to discuss your declaration with your tax preparer, check the authorization box and include their name.

- If applicable, the preparer must sign and fill in their details, including Social Security number or PTIN.

- Once all sections are complete, save your changes, and you may choose to download, print, or share the form.

Complete your Hs131 online today to ensure your property is correctly classified for tax purposes.

Filling in the TM30 form involves providing detailed information about your residency and travel history. Start by entering your full name, visa details, and residential address. It’s essential to provide accurate data to avoid complications. With the help of UsLegalForms, the process can be simplified, ensuring you correctly fill in each section of the TM30 form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.