Loading

Get Form Su 452pdffillercom

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form Su 452pdffillercom online

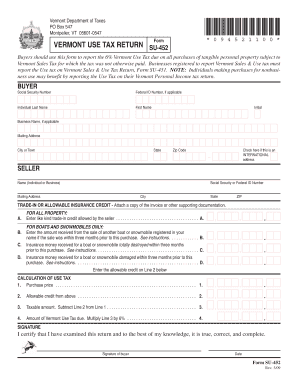

The Vermont Use Tax Return, Form SU-452, allows buyers to report the 6% Vermont Use Tax on tangible personal property purchased where sales tax was not paid. This guide provides a step-by-step approach for filling out the form online, ensuring you complete it accurately and efficiently.

Follow the steps to fill out the Form Su 452pdffillercom online.

- Press the ‘Get Form’ button to access the form and open it within the online editor.

- Complete the Buyer section by entering your information: Social Security Number, Federal ID Number (if applicable), individual’s last name, first name, initial, business name (if applicable), mailing address, city or town, state, zip code, and check the box if the address is international.

- Fill in the Seller section with the name (individual or business), Social Security or Federal ID Number, mailing address, city, state, and ZIP code.

- If applicable, provide details for the trade-in or allowable insurance credit by entering the like-kind trade-in credit allowed by the seller, including required supporting documentation.

- Proceed to the Calculation of Use Tax section. Enter the purchase price on Line 1, the allowable credit from the previous section on Line 2, and calculate the taxable amount on Line 3 by subtracting Line 2 from Line 1.

- Calculate the amount of Vermont Use Tax due on Line 4 by multiplying the taxable amount (Line 3) by 6%.

- In the Signature section, certify the accuracy of your information by signing and dating the form.

- Complete the second side of the form if needed by providing a description of the item(s) purchased, including the date of purchase, make, model, year, and identification numbers.

- Finally, review your entries for accuracy, save your changes, and choose to download, print, or share the completed form as necessary.

Complete your forms online today and ensure compliance with Vermont tax requirements.

To file form V, simply visit Form Su 452pdffillercom and access the relevant filing section. The platform provides comprehensive instructions to assist you in completing the form accurately. Ensure you have all necessary information organized to facilitate a quick and efficient filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.