Get Texas Motor Fuel Transporter Report Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Motor Fuel Transporter Report Form online

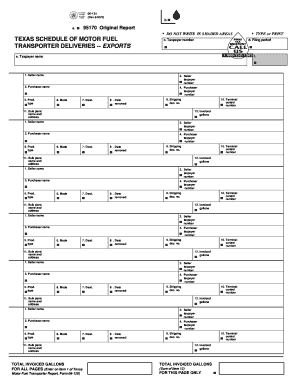

The Texas Motor Fuel Transporter Report Form is essential for documenting the transportation of motor fuel outside the state. This guide provides clear, step-by-step instructions for filling out the form online, ensuring you meet all requirements effectively.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin filling in your taxpayer number in the designated field. Make sure this number is accurate to avoid any compliance issues.

- Enter your name in the taxpayer name section. This should be the name that corresponds with your taxpayer number.

- Input the seller's name and taxpayer number. This is required for identifying the source of the fuel being transported.

- Provide the purchaser's name and taxpayer number. This ensures proper tracking of the transaction.

- Select the product type from the options available. Use the three-digit codes specified — for example, 065 for gasoline.

- Indicate the mode of transportation by entering the respective character (J for Truck, R for Rail, B for Barge).

- Specify the destination by entering the two-character state abbreviation. If it is outside the U.S., enter 'ZZ'.

- Fill in the date the fuel was physically removed from the terminal, formatted as MM/DD/YY.

- Enter the shipping document number associated with the removal of the product. If summarizing multiple transactions, you may enter 'SUM'.

- Provide the terminal control number related to the facility from which the fuel was taken.

- Input the invoiced gallons, rounding to the nearest whole gallon. Be sure this aligns with the summary of transactions you are reporting.

- Review all entered information for accuracy. Once verified, you can save the changes, download, print, or share the form as needed.

Complete and submit your Texas Motor Fuel Transporter Report Form online today to ensure compliance with state regulations.

Yes, Texas requires vehicles over 26,000 pounds to comply with IFTA regulations. This agreement simplifies fuel tax reporting for transporters operating in multiple states, ensuring ease of compliance. For those dealing with fuel transportation, the Texas Motor Fuel Transporter Report Form must be completed. Utilizing resources like uslegalforms can ease the burden of tracking and filing necessary documentation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.