Loading

Get Form 50 283

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 50 283 online

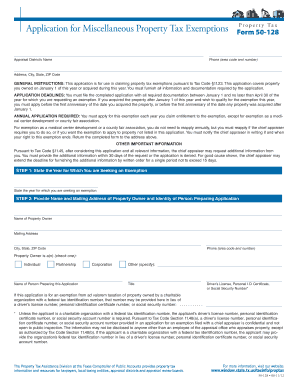

Form 50 283 is crucial for claiming property tax exemptions. This guide provides clear instructions for filling out the form online, ensuring you understand each section and submit a complete application.

Follow the steps to complete your Form 50 283 online.

- Press the ‘Get Form’ button to access the form and open it in your editor.

- Indicate the year for which you are seeking an exemption in the designated field.

- Provide the name and mailing address of the property owner, as well as the identity of the person preparing the application. Ensure you check the appropriate box to denote whether the property owner is an individual, partnership, corporation, or other.

- Select the type of exemption you are requesting by checking the appropriate boxes related to the organization.

- Answer the required questions about the organization, detailing its purpose and activities. Attach additional sheets if necessary.

- If applying for a county fair association, complete the specific questions related to their operations.

- Describe the property for which you are seeking an exemption and ensure all required Schedules A and B forms are attached.

- Finally, read, sign, and date the application, certifying the accuracy of the information provided.

- After completing the form, you can save your changes, download, print, or share the form as needed.

Complete your Form 50 283 online now to claim your property tax exemption!

To mail a Texas franchise extension, you will need to send your completed extension request form to the Texas Comptroller of Public Accounts. This form must be postmarked by the due date to avoid penalties. Ensure that you check the official Texas Comptroller website for any changes in mailing addresses or additional requirements. Using services like uslegalforms can streamline the preparation of your extension request.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.