Loading

Get Form 05

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 05 online

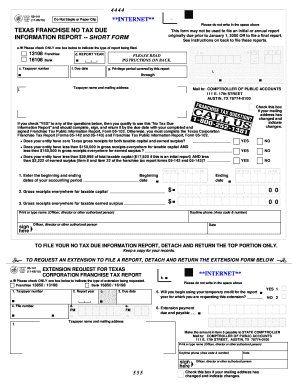

Filling out the Texas Franchise No Tax Due Information Report—Short Form, known as Form 05, is essential for organizations with minimal tax responsibility. This guide provides clear and straightforward instructions on how to complete this form online, ensuring compliance and ease of filing.

Follow the steps to complete Form 05 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Select the type of report you are filing by checking only one box. You can choose between franchise or bank report types.

- Enter the report year in the designated field.

- Fill in your taxpayer number in the appropriate section.

- Provide the due date for the report.

- Indicate the privilege period covered by this report, specifying the beginning and ending dates of your accounting period.

- Complete the gross receipts section. Enter the gross receipts everywhere for taxable capital and taxable earned surplus.

- If your mailing address has changed, check the corresponding box and indicate the new address.

- Print or type the name of an officer, director, or other authorized person responsible for this report.

- Include the daytime phone number with the area code.

- Date the form before submission.

- Once all sections are completed, save changes, download, or print the form. Ensure you return only the top portion of the form as indicated for filing.

Complete your Form 05 online to ensure compliance with the Texas Franchise Tax requirements.

The XT letter from the Texas Comptroller is a notification that confirms that your business is in good standing concerning franchise tax requirements. It often accompanies the Form 05 filing. Receiving this letter is essential for ensuring your compliance with Texas tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.