Loading

Get Investor Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Investor Form online

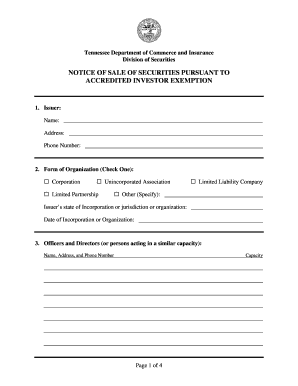

Completing the Investor Form online is a straightforward process that ensures compliance with state regulations concerning securities. This guide will provide clear instructions on effectively and accurately filling out each section of the form to facilitate your investment needs.

Follow the steps to complete the Investor Form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

- Begin by filling out the issuer's information, including the name, address, and phone number. Ensure this information is accurate as it establishes the identity of the issuing entity.

- Select the form of organization by checking one of the following options: Corporation, Unincorporated Association, Limited Partnership, Limited Liability Company, or Other (if applicable). Additionally, provide the issuer’s state of incorporation or jurisdiction and the date of incorporation or organization.

- List the names, addresses, and phone numbers of the officers and directors, or persons acting in a similar capacity in the designated section. Indicate their capacity within the organization.

- In the offering section, provide a clear description of the security being offered, the price per security, the number of securities to be offered, and the aggregate dollar amount. Further categorize the offering into debt, equity (common or preferred), convertible security, partnership interests, or other as appropriate.

- Provide a brief description of the business associated with the securities offered, ensuring clarity regarding the nature of the operations.

- Indicate the name of the broker-dealer who has solicited or intends to solicit purchasers in the state, as required for regulatory compliance.

- Attach any required documents, including: a copy of the general announcement regarding the offering, consent to service of process, and the non-refundable filing fee of five hundred dollars ($500). Ensure that these documents are included with the submission.

- Complete the execution and certification section by providing the issuer's name, signature, title, and the date of submission. Confirm familiarity with the conditions necessary for the Accredited Investor Exemption.

- Once all sections are completed, ensure to save changes, and consider downloading, printing, or sharing a copy of the form for your records.

Begin filling out the Investor Form online today to facilitate your investment process.

Filing for accredited investor status generally means providing proof of your income or assets. This process often involves submitting the relevant documents to a financial institution or platform you wish to invest with. Completing an Investor Form can streamline this process, making it easier for you to demonstrate your accredited status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.