Get State Of South Dakota Substitute W 9 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Of South Dakota Substitute W 9 Form online

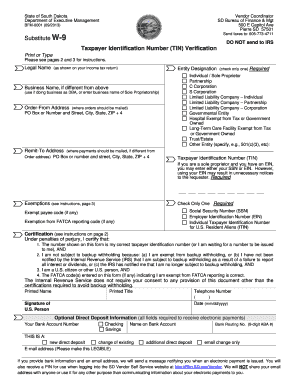

Filling out the State Of South Dakota Substitute W 9 Form online is an essential step for vendors looking to provide accurate taxpayer information to the state. This comprehensive guide offers clear instructions tailored to support users of all experience levels.

Follow the steps to complete the form accurately

- Click ‘Get Form’ button to access the Substitute W 9 Form and open it in your preferred editor.

- Enter your legal name as shown on your income tax return in the designated field. This ensures that the information aligns with state and IRS records.

- If applicable, provide your business name in the relevant section. This is used if you are operating under a doing business as (DBA) name.

- Fill in your order-from address, which is where you want orders to be mailed. Include your PO Box or street address, city, state, and ZIP code.

- If your remit-to address differs from the order-from address, fill this section with the appropriate information for payment receipt.

- Select the applicable entity designation by checking only one box that describes your business structure, such as individual, partnership, or corporation.

- Enter your Taxpayer Identification Number (TIN) in the provided space. Depending on your entity, this could be your Social Security Number (SSN) or Employer Identification Number (EIN).

- If you have any exemptions, check the appropriate box to indicate exemption from backup withholding or FATCA reporting, as applicable.

- Sign the certification section to confirm that all information is correct and that you are not subject to backup withholding, unless you adjust item 2 as necessary.

- Provide your printed name, title, and telephone number in the specified fields, followed by the date of signing.

- If you wish to set up direct deposit, fill in your bank account number, checking or savings designation, bank routing number, and any optional email address.

- Review all entered details for accuracy, then save changes, download, print, or share the completed form as needed.

Start filling out the State Of South Dakota Substitute W 9 Form online today to ensure timely processing of your vendor information.

A W9 in the state refers specifically to the request for Taxpayer Identification Number and Certification that individuals or businesses must complete. In the State Of South Dakota, the Substitute W 9 Form fulfills a similar role but may include state-specific instructions. Understanding this form is crucial for proper tax documentation for services rendered or payments received.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.