Get Ri 1120s

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI-1120S online

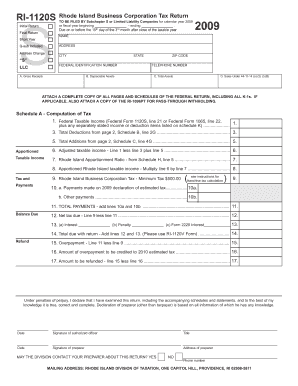

The RI-1120S is a tax return form that must be filed by Subchapter S corporations or limited liability companies in Rhode Island. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the RI-1120S form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the basic information section, including the name, address, federal identification number, and telephone number. Make sure to indicate whether this is an initial or final return and if there's an address change.

- Provide financial details, such as gross receipts and total assets, in the corresponding fields to ensure accurate tax computation.

- Complete Schedule A by entering federal taxable income and any deductions. Follow the instructions provided to determine the correct lines to reference from federal forms.

- Complete Schedule B by detailing any deductions you wish to claim. Ensure to attach all necessary documentation to avoid delays.

- Proceed to Schedule C to report any additions to federal taxable income and include documentation for these items as well.

- Fill out Schedule D to report any Rhode Island credits you are eligible for, ensuring again to attach supporting documents.

- Review additional schedules, such as Schedule F for general information and Schedule H for apportionment tables, providing accurate figures as needed.

- Affix your signature and date on the form in the designated areas to validate your return before submitting.

- Save your changes, and when ready, download, print, or share the completed form for submission.

Complete your RI-1120S online today to ensure timely filing and compliance with Rhode Island tax regulations.

You can find net income on Form 1120S in the income section, specifically on Line 21. This line summarizes your total income and deductions, showcasing your business's profitability. Understanding where to locate this information on the Ri 1120S form helps you get your taxes right and impacts your overall tax liability. If you need guidance, US Legal Forms offers tools to help you navigate Form 1120S efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.