Loading

Get Ri Tdi Refund

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ri Tdi Refund online

Filing for a refund through the Ri Tdi Refund form can seem daunting, but with clear guidance, users can complete the process efficiently. This guide will provide step-by-step instructions to help you navigate each section of the form seamlessly.

Follow the steps to complete your Ri Tdi Refund form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

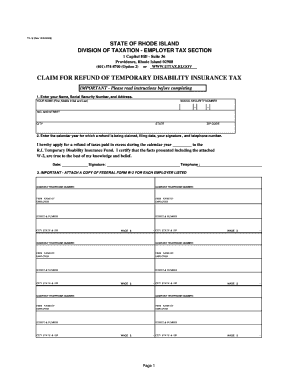

- Begin by filling out Section 1. Enter your full name, including your first name, middle initial, and last name. Next, provide your Social Security Number in the designated format, followed by your residential address, which includes your street address, city, state, and zip code.

- Proceed to Section 2. In this section, indicate the calendar year for which you are claiming a refund. Fill in the date, your signature, and your telephone number. Ensure that all information is accurate as it is crucial for processing your claim.

- In Section 3, list each employer from whom you received wages during the specified calendar year. For each employer, include the firm name, address, telephone number, and the total wages paid. It is important that all listed employers are registered in Rhode Island and taxes were withheld from your wages.

- Attach a copy of your Federal Form W-2 for each employer you have listed in Section 3. Ensure that each W-2 reflects a different Federal Identification Number. Remember that photocopies will not be accepted, and the W-2s must be legible.

- Before submitting the form, double-check all entries for accuracy. Review the Claim for Refund Form to confirm that all sections are completed correctly. Don't forget to sign the form.

- Finally, return the completed form to the Division of Taxation - Employer Tax Section at One Capitol Hill Suite 36, Providence, RI 02908. You can either mail it or follow any procedures for online submission that may apply.

Complete your Ri Tdi Refund form online today for a seamless refund process.

If your refund exceeds $50,000, the IRS may conduct a more thorough review before issuing your RI TDI Refund. You should provide all required documentation promptly to avoid further delays. Additionally, consider consulting a tax professional to navigate any complexities in your filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.