Loading

Get Form 013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 514 online

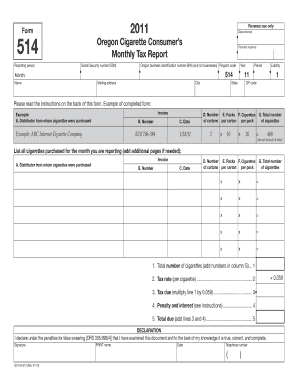

Filling out the Oregon Cigarette Consumer’s Monthly Tax Report, also known as Form 514, can be straightforward with the right guidance. This step-by-step guide will help you accurately complete the form online and ensure your compliance with tax obligations.

Follow the steps to successfully fill out Form 514.

- Press the 'Get Form' button to access the document and open it in the online editor.

- Enter the reporting period by selecting the month in which you received the cigarettes. This should be the month of your purchases.

- If the purchases were for personal use, provide your Social Security number. For businesses, input your Oregon business identification number.

- Indicate the period by entering '1' for January, '2' for February, and so on through December.

- Complete your personal information, including your name, mailing address, city, state, and ZIP code.

- In column A, list the distributor's name from whom you purchased the cigarettes.

- In column B, record the invoice number that corresponds with your shipment.

- Input the date of the invoice in column C.

- Specify the total number of cartons ordered in column D.

- Enter the number of packs in each carton in column E.

- Fill in column F with the number of cigarettes per pack.

- Calculate the total number of cigarettes in column G by multiplying the values in columns D, E, and F.

- On line 1, total the amount of untaxed cigarettes purchased during the reporting period (sum of column G).

- To determine the tax due, multiply the number on line 1 by 0.059, and enter this value on line 3.

- If applicable, calculate any penalty and interest on line 4 based on late payment information provided in the instructions.

- Add lines 3 and 4 together to get the total due on line 5.

- Sign the declaration, date it, and include your telephone number at the bottom of the form.

- Once completed, save your changes. You will have the option to download, print, or share the form according to your needs.

Complete your Form 514 online today to stay compliant with tax regulations.

To fill up Form 013, you should review each section carefully before starting. Make sure all required fields are completed, including sender and recipient information, and any relevant payment details. Following the instructions closely will help avoid mistakes and delays. US Legal Forms can help facilitate this process with templates and tips that assist you in getting it right.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.