Get Oregon Combined Registration Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oregon Combined Registration Form online

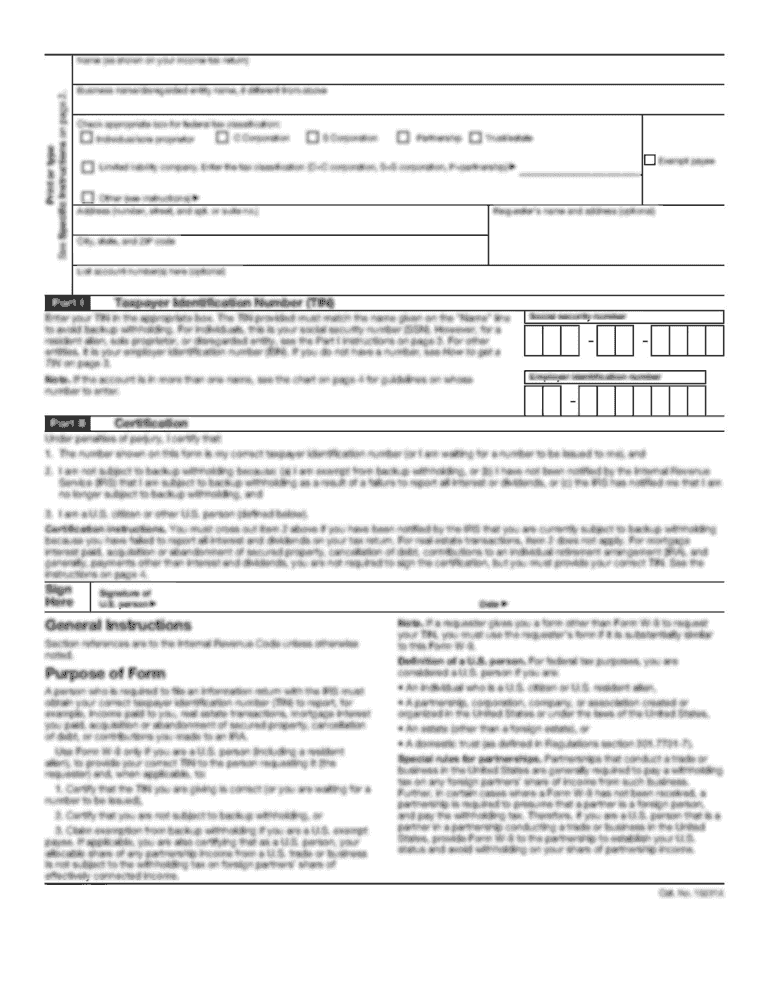

The Oregon Combined Registration Form is essential for reporting payroll taxes and employee details to the appropriate state departments. This guide provides clear, step-by-step instructions to help users effectively complete the form online.

Follow the steps to successfully complete the Oregon Combined Registration Form.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Review the employer information section and enter your name, mailing address, Oregon business identification number (BIN), and federal employer identification number (FEIN). Correct any discrepancies using the Business Change in Status Form.

- In the section for the number of covered workers, include all full-time and part-time workers who were employed during the payroll period that includes the 12th of the month.

- Complete the columns for each tax program by entering the total annual subject wages paid and the total tax owed to each state program.

- In the Unemployment Insurance (UI) section, enter the subject wages, excess wages, taxable wages, and calculate the total tax owed.

- Fill out the State Withholding section, entering total Oregon income tax withheld and any tax prepaid.

- If applicable, complete the Workers’ Benefit Fund (WBF) assessment section by reporting the total hours worked by employees subject to the WBF assessment.

- Check all entries for accuracy and completeness before final submission. If necessary, attach Form OTC with payments.

- Save your changes, and choose to download, print, or share the completed form as needed.

Start filling out your Oregon Combined Registration Form online today to ensure timely tax reporting.

Yes, in Oregon, married couples can choose to file their taxes separately. This option may benefit certain financial situations or preferences, providing flexibility in how you manage your tax obligations. When using the Oregon Combined Registration Form, make sure to indicate your filing status correctly to avoid any confusion. The uslegalforms platform can assist in ensuring that your filing is done accurately and in compliance with state regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.