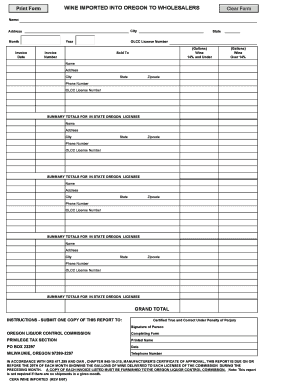

Get Oregon Wine Imported Into Oregon To Wholesalers Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Oregon Wine Imported Into Oregon To Wholesalers Form online

Filling out the Oregon Wine Imported Into Oregon To Wholesalers Form online can seem daunting, but this guide will walk you through each step to ensure you complete it accurately and efficiently. This form is essential for reporting the gallons of wine delivered to Oregon wholesalers, helping you comply with state requirements.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the form. This will allow you to obtain the document and open it for filling out.

- Begin by entering your name as it appears on your Oregon Liquor Control Commission (OLCC) license. Be sure to fill in all the required fields, including your city and address.

- Specify the month and year for which you are reporting the imported wine. This information is crucial for regulatory compliance.

- Enter your OLCC license number, which identifies your business in the state's records. Next, fill out the invoice date and invoice number from your records.

- Under 'Sold To,' provide the name, address, city, state, zip code, and phone number of the wholesaler to whom the wine was sent. Ensure accuracy, as this information is used for tracking and reporting.

- Record the gallons of wine imported in two categories: 'Wine 14% and Under' and 'Wine Over 14%.' Make sure to tally the quantities accurately for compliance.

- Sum up the totals for each Oregon wholesaler in the provided fields. This summary is critical for your records and for submission.

- Calculate the grand total of the gallons shipped into the state. This cumulative figure will reflect your overall import volume for the reporting period.

- Signature is mandatory. The person completing the form must sign to certify its accuracy, along with printing their name, date, and telephone number for future contact.

- Once all sections are filled out, review the form for accuracy. You can then choose to save your changes, download a copy for your records, print the form, or share it as required.

Begin filling out your Oregon Wine Imported Into Oregon To Wholesalers Form online today for seamless compliance with state requirements.

Yes, Oregon does impose a specific tax on wine, classified under excise taxes. The rates can depend on the type of wine and quantity sold. If you're dealing with Oregon Wine Imported Into Oregon To Wholesalers Form, being informed about these tax structures can help you maintain compliance while optimizing profit margins.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.