Loading

Get Oklahoma Amended Tax Return Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oklahoma Amended Tax Return Form online

This guide provides clear and supportive instructions for users on how to complete the Oklahoma Amended Tax Return Form (Form 511X) online. By following these steps, individuals can efficiently amend their tax returns with confidence.

Follow the steps to fill out the Oklahoma Amended Tax Return Form successfully.

- Click ‘Get Form’ button to obtain the Oklahoma Amended Tax Return Form and open it in the editor.

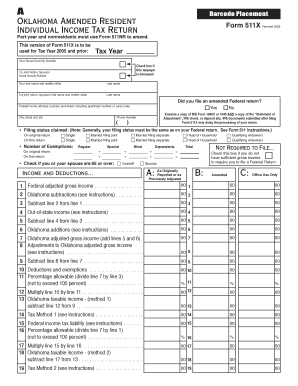

- Fill in the tax year you are amending to ensure the correct version of the form is used. Provide your Social Security Number, ensuring any checks for status such as 'deceased' are marked if applicable.

- Indicate if you filed an amended Federal return by checking 'Yes' or 'No'. If you answered 'Yes', enclose a copy of IRS Form 1040X or 1045 along with any required documentation.

- Enter your present home address accurately, including city, state, and zip code. Ensure your phone number is provided for any queries related to your application.

- Select your filing status consistent with your original return, such as Single, Married Filing Joint, or Head of Household. Provide the number of exemptions you are claiming.

- In the income section, report your Federal adjusted gross income and other necessary adjustments, noting specific figures in the designated columns.

- Calculate your Oklahoma adjusted gross income by subtracting out-of-state income and adding Oklahoma-specific adjustments as applicable.

- Detail your deductions, exemptions, and any tax credits you may be eligible for, following the provided instructions for each section.

- After filling out all necessary fields, review the return for any omitted information and ensure all supporting documents are enclosed as required.

- Once completed, you may save your changes, download the form for your records, print it for submission, or share it as needed.

Start completing your Oklahoma Amended Tax Return Form online now for a smoother filing experience.

To submit a revised return, you will need to use the Oklahoma Amended Tax Return Form and follow the specific guidelines provided by the state. Ensure that you clearly mark the form as 'amended' and include only the revisions. After completing the form, submit it by mail, or by the secure online service offered by uslegalforms for an efficient process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.