Loading

Get Form 500 A

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 500 A online

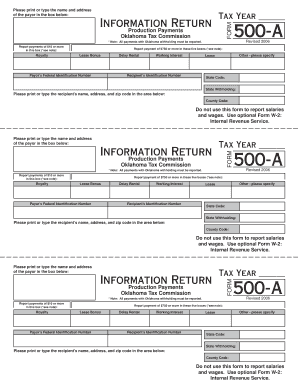

Filling out the Form 500 A is essential for reporting production payments made within the state of Oklahoma. This guide will provide you with clear, step-by-step instructions to help you complete the form online with confidence.

Follow the steps to successfully complete the Form 500 A online.

- Press the ‘Get Form’ button to download the form and access it in your document editor.

- In the first section, print or type the name and address of the payor in the designated box.

- Next, report payments of $10 or more in the provided box. Ensure that you follow the note indicating that all payments with Oklahoma withholding must be reported.

- If reporting payments of $750 or more, complete the five additional boxes for various payment types, including royalty, lease bonus, delay rental, working interest, and any other applicable types.

- Enter the payor’s federal identification number accurately.

- Fill in the recipient’s identification number in the appropriate field.

- Specify the state code and state withholding information as required.

- Print or type the recipient’s name, address, and zip code in the designated area.

- Complete the county code field.

- Finally, review all entries for accuracy. You can then save your changes, download, print, or share the completed form as needed.

Start the process of completing your Form 500 A online today!

You should file GA 500 NOL by the due date of your Georgia income tax return for the year in which the net operating loss occurred. Filing on time is crucial to ensure you receive the benefits associated with your losses. Keeping track of deadlines can prevent potential penalties or issues with your tax return. If you need help navigating the filing process, uslegalforms offers tools and resources tailored for your needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.