Loading

Get Oklahoma Form 507

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oklahoma Form 507 online

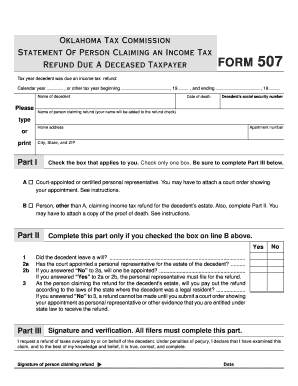

Filling out the Oklahoma Form 507 online is a crucial step for individuals seeking to claim an income tax refund on behalf of a deceased taxpayer. This guide will provide a clear, step-by-step process to assist users in completing the form accurately and efficiently.

Follow the steps to successfully complete Oklahoma Form 507 online.

- Click ‘Get Form’ button to access the Oklahoma Form 507 and open it in your preferred online editor.

- Begin by reviewing the purpose of Form 507. Ensure you are eligible to file this form, which is intended for claiming an income tax refund for a deceased taxpayer.

- In Part I, select the appropriate box indicating whether you are the court-appointed personal representative or another individual claiming the refund. If applicable, attach the required court order or proof of death.

- Complete Part II by answering questions regarding the decedent's estate. Indicate whether the decedent left a will and if a personal representative has been appointed.

- If qualifying under line B of Part I, provide any necessary documents such as proof of death to complete your claim.

- Finish by signing and dating Part III of the form, which includes a declaration of the accuracy of your claim.

- Once all information is entered and reviewed, proceed to save any changes, download, print, or share the completed Form 507 as required.

Take the next step in your claim process by completing your documentation online today.

Entities such as corporations and limited liability companies doing business in Oklahoma are required to file an Oklahoma franchise tax return. This requirement helps ensure that these businesses contribute to the state's economy. For clarification on specific filing processes, consulting the Oklahoma Form 507 can provide additional guidance on maintaining compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.