Loading

Get Oklahoma Backup Withholding

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oklahoma Backup Withholding online

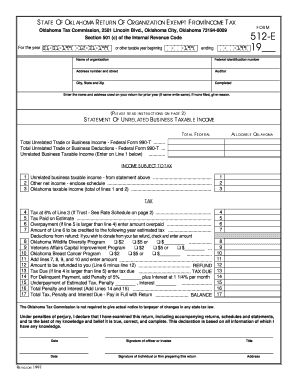

This guide provides clear and supportive instruction on completing the Oklahoma Backup Withholding form online. It is designed for users with varying levels of experience in digital document management.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to obtain the Oklahoma Backup Withholding form and open it in your editor.

- Enter the name of the organization in the designated field as it appears in your official records.

- Provide the federal identification number associated with the organization in the appropriate section.

- Fill in the complete address, including the number and street, city, state, and zip code.

- Indicate the auditor's name if applicable, or leave blank if not.

- Refer to the section for prior year information, entering the name and address used in your previous tax return. If none was filed, provide a reason for the omission.

- Complete the Statement of Unrelated Business Taxable Income by filling in total federal income, allocable Oklahoma income, total unrelated trade or business income, and total deductions.

- Calculate the Oklahoma taxable income by adding the unrelated business taxable income and any other net income, ensuring to enclose necessary schedules.

- Proceed to the tax calculations section, entering the applicable taxes based on the calculated Oklahoma taxable income.

- Complete the sections for overpayment, deductions from refund, and amount to be refunded or tax due as necessary.

- If applicable, add any penalties or interest due before proceeding to the final steps.

- Review all entered information for accuracy, then save changes, and choose to download, print, or share your completed form as needed.

Complete your Oklahoma Backup Withholding form online today!

To reclaim withholding tax, you need to file an amended tax return and any necessary forms to request a refund. Ensure you clearly indicate the tax year in question and provide proof of the withheld amounts, including any Oklahoma Backup Withholding. Timing is crucial, so be mindful of deadlines for filing claims. USLegalForms can assist you in understanding the refund process and help you prepare the required documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.