Loading

Get Oes 1 Instructions Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Oes 1 Instructions Form online

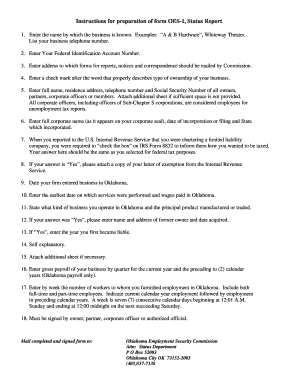

Completing the Oes 1 Instructions Form online is essential for businesses in Oklahoma to ensure compliance with employee reporting requirements. This guide provides clear, step-by-step instructions to facilitate your experience.

Follow the steps to complete the Oes 1 Instructions Form effectively.

- Press the ‘Get Form’ button to access the form and open it in your document viewer.

- Input the name by which your business is recognized, such as 'A & B Hardware.' Include your business telephone number next to the name.

- Enter your Federal Identification Account Number in the designated field.

- Provide the business mailing address where you would like the Oklahoma Employment Security Commission to send reports and notices.

- Select the type of ownership for your business by marking the appropriate option.

- List the full names, residence addresses, telephone numbers, and Social Security Numbers for all owners, partners, corporate officers, or members of the business. If there is insufficient space, attach an additional sheet.

- If applicable, state the full corporate name as it appears on your corporate seal along with the date of incorporation or filing, and the state of incorporation.

- Indicate your chosen taxation status as filed with the U.S. Internal Revenue Service on Form 8832.

- If your business qualifies for exemption, attach the relevant documentation from the Internal Revenue Service.

- Provide the date your firm started operating in Oklahoma.

- State the earliest date that your business performed services and began paying wages in Oklahoma.

- Describe the nature of your business and the primary products manufactured or traded within Oklahoma.

- If you acquired an established business, provide the name and address of the former owner along with the acquisition date.

- Confirm whether you are liable under the Federal Unemployment Tax Act and, if so, specify the year you became liable.

- Show the addresses of all business locations in Oklahoma that your firm operates.

- Enter your gross payroll data by quarter for the current year and the two preceding calendar years for Oklahoma.

- Record the number of workers employed in Oklahoma each week. Make sure to track both full-time and part-time employees.

- Ensure that the form is signed by an owner, partner, corporate officer, or authorized official before submission.

- Save your changes, and consider downloading, printing, or sharing the completed form as needed.

Complete your documents online today to ensure accurate reporting and compliance.

When writing instructions for filling out a form, be clear and straightforward in your language. Break down the form into sections, explaining what information is needed for each part. Referencing the Oes 1 Instructions Form can serve as an excellent model, helping users navigate their way through the process effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.