Loading

Get Form 26d

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 26d online

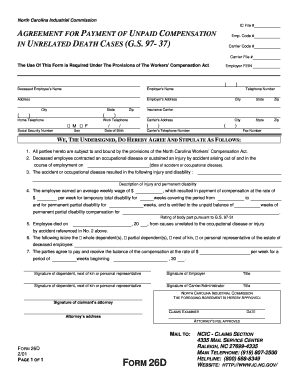

Filling out Form 26d is an essential step in the process of securing compensation in unrelated death cases under North Carolina's Workers' Compensation Act. This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the Form 26d online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the required information for the deceased employee including their full name, date of birth, and Social Security number. Ensure accuracy as this information is critical for processing the claim.

- Fill in the employer information by providing the employer's name, address, and Federal Employer Identification Number (FEIN). Include the employer's contact details such as phone number.

- Document the incident details by stating the date of accident or the occurrence of the occupational disease. Provide a thorough description of the injury and any resulting permanent disabilities.

- Indicate the average weekly wage earned by the deceased employee. Fill in the compensation rates for both temporary total and permanent partial disabilities, ensuring that you specify the time periods for which each applies.

- Record the date of the employee’s death and confirm that it is unrelated to the aforementioned occupational injury or disease.

- List the dependents or next of kin of the deceased employee, clearly identifying whether they are whole or partial dependents.

- Specify the compensation agreement by indicating the amount to be paid weekly and the total duration for which payments will be made.

- Collect the necessary signatures from the dependents, the employer, and the insurance carrier or administrator. Ensure all parties sign and provide any requested titles.

- Before finalizing, review all the entered information for completeness and accuracy. Save changes, then proceed to download, print, or share the filled form as needed.

Complete your Form 26d online today to ensure timely processing of your compensation claim.

Yes, you can file your ITR using Form 26AS as it captures all the TDS deductions made on your behalf. This form serves as a comprehensive record of taxes deducted, which can aid in accurate reporting of your income. For a seamless filing experience, consider using USLegalForms to navigate the integration of Form 26AS into your ITR efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.