Loading

Get Os 114 Form 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OS 114 Form 2019 online

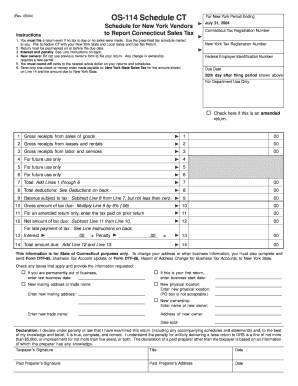

The OS 114 Form 2019 is a key document for vendors operating in New York who need to report Connecticut sales tax. This guide provides you with clear and comprehensive instructions on how to successfully fill out the form online, ensuring compliance with relevant tax regulations.

Follow the steps to fill out the OS 114 Form 2019 online.

- Click ‘Get Form’ button to obtain the OS 114 Form 2019 and open it in the editor.

- Enter your Connecticut tax registration number. This number is essential for identifying your business in Connecticut’s tax system.

- Input your New York tax registration number. This helps link your sales activities in New York to your tax obligations.

- Provide your federal employer identification number. This information is required for tax processing.

- Fill in the due date, which is the 20th day after the filing period indicated in the form.

- If applicable, check the box indicating if this is an amended return.

- Proceed to list gross receipts from the sale of goods, leases and rentals, and labor and services in the respective fields.

- Calculate total gross receipts by adding the amounts from the appropriate lines.

- Enter total deductions as specified on the form. You must be detailed and precise to avoid discrepancies.

- Determine the balance subject to tax by subtracting total deductions from total gross receipts.

- Calculate the gross amount of tax due by multiplying the balance subject to tax by the applicable tax rate.

- If filing an amended return, include the tax paid on any previous returns for this period.

- Compute the net amount of tax due by subtracting any taxes previously paid from the gross amount calculated.

- If applicable, enter any interest or penalty fees for late payments.

- Finally, add the calculated amounts to determine the total amount due.

- Review all entries for accuracy. Save your changes, download a copy, print, or share the completed form as necessary.

Complete your OS 114 Form 2019 online today to ensure compliance and avoid penalties.

Filing an LLC in Connecticut online is straightforward through the Secretary of State's website. You will need to provide your LLC name, address, and other pertinent details during the registration process. Consider familiarizing yourself with the OS 114 Form 2019, as it can aid you in understanding related tax obligations once your LLC is established.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.