Loading

Get Form Ct 3m4m

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Ct 3m4m online

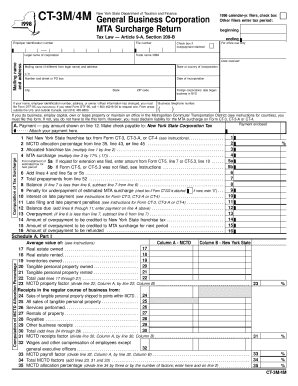

The Form Ct 3m4m is a crucial document for general business corporations filing the MTA surcharge return in New York. This guide will provide you with a clear, step-by-step process to successfully complete this form online.

Follow the steps to fill out the Form Ct 3m4m online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your employer identification number in the designated field. This is a unique number assigned to your business for tax purposes.

- Next, provide your legal name of the corporation and any trade name or DBA. Ensure that the names are consistent with official records.

- Fill out the mailing address section, making sure to include the street address, city, state, and ZIP code. If your mailing name is different, include that as well.

- Indicate your state or country of incorporation and the date of incorporation. This helps clarify your business's legal status.

- Complete the section related to the business operations in New York State, including the date your business began operating in the state and the business telephone number.

- When detailing the computation of the tax surcharge, follow the prompts to provide accurate financial information based on your franchise tax and other financial factors as outlined in the form.

- Carefully calculate the MCTD allocation percentage using the provided formulas. This percentage is important for determining your tax responsibilities.

- Review all calculations and ensure that you have checked all applicable boxes, such as those for overpayments or extensions.

- Finally, certify the completion of the return by signing in the required section. This confirms that the information provided is true and accurate.

- Once you have completed all required sections, save your changes. You can download, print, or share the completed form as necessary.

Complete your documents online to ensure timely and accurate submissions.

To fill out an expense reimbursement form, start by identifying the categories for each expense. Clearly itemize the amounts, ensuring you provide appropriate descriptions and dates. Attach any necessary documentation to support your request. If you encounter any challenges, the Form CT 3M4M can provide necessary guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.